One major challenge facing the global bioindustry today is finding talented individuals to work in the type of highly skilled interdisciplinary environments necessary for effective bioprocess development. Ideally, such individuals require a combination of technical knowledge and expertise spanning biological sciences, physical sciences, mathematics, and engineering. Numerous industry surveys have repeatedly stressed the lack of suitably trained individuals equipped with necessary skills to work at the biologyâengineering interface to meet the growing and changing demands of industry. The challenge is…

Business

Hands-On Training for Biopharmaceutical Careers: Trainees Gain Practical Experience in Realistic Production Environments

At the April meeting of the BPI International Summit (25â26 April 2017) delegates were treated to a tour of a new training facility. The Biotech Training Facility is about a 20-minute drive from the Amsterdam airport and located in the Leiden Bioscience Park. The park houses companies that employ ~18,000 life science workers. In addition, the Leiden University and the Leiden Academic Medical Center complement the dynamic high-tech environment that facilitates establishment of such a knowledge and experience center as…

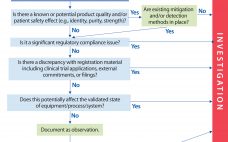

Transforming Deviation Management

All biopharmaceutical companies espouse a belief in scientific, risk-based approaches. However, with respect to deviation management systems (DMSs), the industry is falling short of that promise. By and large, companies still use a small-molecule pharmaceutical compliance model that dates back to the 1980s, based on the strategy that all deviations are created equal and require 30-day closure. Most bioprocessors still hold to a default 30-day rule, even though there is no specific regulatory requirement for that time frame. Major or…

Chinaâs Biopharmaceutical Companies Target Global Markets

Global perspectives of China as a major biopharmaceutical supplier have changed over the past decade. In 2008, BioPlan Associates completed its first analysis and directory of the top 60 biopharmaceutical facilities in China (1). Based on findings from our study titled Advances in Biopharmaceutical Technology in China (2), we found that China clearly held the image of a low quality manufacturer of biogeneric products almost exclusively for its domestic market. Further, concerns over intellectual property protection, contracting problems, and management…

Emerging Markets: Current Insights into the State of Global Biopharmaceutical Manufacturing

Opportunities for establishing strong biopharmaceutical capabilities are expanding across the globe. This e-book seeks to encapsulate the current state of emerging markets/countries, tracing key elements above and offering examples to show where (in the world) the biopharmaceutical industry is expanding and securing its footholds. Generally, to succeed in these markets, foreign companies must exercise efficient resource management and control, show creativity and receptiveness to cultural differences, develop new strategies, and manage expectations. Working with local partners can provide access to…

Regulation, Analytical, and Process Issues with Leachables: Toward Harmonization for Latin America with Europe and North America

The pharmaceutical industry follows strict regulations regarding impurities, including process-related leachates. Plastic manufacturers use hydrophobic, nontoxic additives for manufacturing containers for use in the pharmaceutical and food industries. However, some issues about dealing with such impurities are not yet resolved. In developing countries, regulators are working on guidelines to help local companies ensure characterization of impurities. In this exclusive editorial eBook, authors from Mexico describe some issues related to plastic leachables in the context of ongoing efforts to harmonize regulations…

Innovating in Franceâs Auvergne-RhĂŽne-Alpes Region

Lyonbiopole is a French âbio-clusterâ based in the Auvergne-RhĂŽne-Alpes region surrounding Lyon (Figure 1). The cluster supports ambitious projects and companies in the broad health industry, counting more than 200 members including Lyonbiopoleâs four founders: Sanofi Pasteur (the vaccines division of multinational pharmaceutical company Sanofi), bioMĂ©rieux (known worldwide for in vitro diagnostics and microbiological testing), Merial (an animal-health company that merged recently with Boehringer Ingelheim), and Becton Dickinson (supplier of flow cytometers, reagents, tools, and services). The region also is…

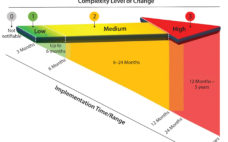

An Industry Proposal for Change Notification Practices for Single-Use Biomanufacturing Systems

Current practices for change notification in the biopharmaceutical industry are neither efficient nor conducive to accelerating the adoption of single-use systems (1, 2). Drug manufacturers (end users) often observe that supplier change data packages lack technical content or detail and that the time allowed for change implementation is too short. Occasionally, customers (end users or next tier in supply chain) learn of changes after the fact, possibly even by happenstance. Suppliers, however, can find the potential affect of a change…

Introduction: Tackling the Technical and Regulatory Challenges of Biosimilar Development

In a just a few years, the biopharmaceutical industry has gone from questioning the feasibility of âfollow-on biologicsâ (around the time of BPIâs first issues) to fearing them (when we published our first supplement on the topic in 2013) to the acceptance and strategizing of today. Perhaps because of its more socialized medicine, Europe led the way in biosimilar regulation and approved its first such product nearly 10 years before the first US biosimilar launch in 2015. In between came…

Biosimilar Markets and Regulation: Which Countries Are Going All In?

The pipeline of follow-on (biosimilar and biobetter) products in development for the US, EU, and other major markets is very healthy. It includes nearly 800 biosimilars, about three-quarters of which are presumed to be targeted for major markets, and about 500 biobetters in development. Nearly 1,200 follow-on biopharmaceutical products in the development pipeline are intended to compete with more than 100 currently marketed biopharmaceuticals. This is not just an opportunity in the Western world; biosimilars development is expanding globally. But…