Achieving efficient and profitable market access for next-generation pharmaceutical products is extremely challenging. The number of drug launches is rising every year, taking competition levels higher with them. And because these novel products tend to be more tightly targeted to smaller patient populations than the “blockbuster” drugs of old, their pricing/reimbursement terms need to be tailored to match. This is especially the case with highly complex biologic drugs, which typically are expensive to research and develop. Below I offer a…

BioRegions

Bioprocessing Facilities in Asia Consider Domestic Alternatives to Western Suppliers

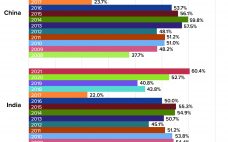

The global biopharmaceutical industry had been growing robustly even before the COVID-19 pandemic. According to the BioPlan Associates Top 1000 Biofacility Index and Biomanufacturers Database (1), bioprocessing capacity worldwide increased an average of 12% over the past decade. China has seen nearly double that rate. India’s bioprocessing segment also is showing strong growth. Because those regions represent 37% of the world’s population — and with rapidly growing middle-class economies, — demand for biologics there is outstripping that elsewhere. Historically, Western…

The Power of Industry Collaboration: Driving Harmonization of Regulatory Requirements

The biopharmaceutical industry continues to develop advanced manufacturing processes, systems, technologies, and facilities. Regulations play a significant role in assessing and approving marketing authorizations for drug products that are submitted for approval. The industry and regulators together should form a coordinated, streamlined process that delivers much-needed medicines around the world. Global Complications The complex global nature of biopharmaceuticals sometimes means that progress is not always as smooth as it could be. One main reason is that regulatory agencies often differ…

The Next Global Life-Science Leader

Canada’s life-science industry is exceptional at producing innovative research. With less than 0.5% of the world’s population, our country produces 5% of the globe’s total research publications. Canada’s citation rate ranks among the top six nations and is 43% higher than the global average (1). At the same time, our life-science industry is competing with other global jurisdictions into which investment is flowing. The US state of Massachusetts, already the number one biotechnology cluster in the world, has committed US$1.5…

Biopharmaceutical Growth in China: Bioprocessing Challenges Are Creating CMO Opportunities

In the past decade, the world has seen rapid growth of more than 15% in China’s biopharmaceutical market (1). According to the second edition of BioPlan’s Advances in Biopharmaceutical Technology in China, the most populous country in the world — with the largest patient groups — has a growing economy with its GDP second only to that of the United States. Rapid urbanization and greater access to national healthcare insurance puts China in second place after the United States for…

Good Manufacturing Practice in China: Equipment Strategy and Quality Management to Compete with the West

Although the concept of good manufacturing practice (GMP) was created about half a century ago in the United States, the history of GMP biomanufacturing is relatively short in China, with the first version of GMP rules issued by the Ministry of Health in 1998. In 2010, the ministry issued its fourth version of China’s GMP rules, which came into effect in March of 2011 (1). According to a recent report from BioPlan Associates, the 2010 version raised the standards to…

China Looks Inward and Outward: Investments in US and EU Biopharmaceutical Companies Are on the Rise

The growth momentum of China’s biopharmaceutical industry continues, with the China Industry Research Institute projecting that the country’s biological therapeutics market could reach 300 billion Chinese yuan (~US$50 billion) in 2019. According to the second edition of our report on advances in Chinese biopharmaceutical technology, this robust growth is boosted by continuing investment into the sector (1). A clear strategic indicator of the country’s intentions in biotherapeutics and biologics has been government investment in bioindustrial hubs, which by next year…

China Can Be Ignored No Longer: Long-Term Biopharmaceutical Opportunities Based on Near-Term Demonstrated Growth

China has long served as “the world’s factory,” but many experts in the biopharmaceutical industry have assumed that making consumer electronics, clothing, and toys for a global consumer base does not translate well to making complex biologics on the global stage. However, according to a newly released report, the biopharmaceutical market in China reached a value over US$9 billion in 2018, with the domestic monoclonal antibody (MAb) market there making up a very large percentage of that (1). Much of…

Methods on the Move: Addressing Method Transfer Challenges for the Biopharmaceutical Industry

Analytical method transfers are essential components of the current global biotechnology environment. Analytical method transfer can be defined as “a documented process that qualifies a laboratory (the receiving laboratory) to use a validated analytical test procedure that originated in another laboratory (sending laboratory), thus ensuring that the receiving laboratory has the procedural knowledge and ability to perform the transferred analytical procedure as intended” (1). The goal is to ensure that a method continues to perform in the validated state regardless…

Demand for Capacity Drives China’s Biomanufacturing Expansion

Over the past year, most of China’s biomanufacturing facilities have been engaged in active facility expansion. Based on our research of facilities under active construction, that growth has expanded total capacity in China by over 10%. Our research updates the Top 60 Biopharmaceutical Manufacturers in China directory from BioPlan Associates (1) and shows a continuing increase in new bioprocess capacity. This trend is unlikely to abate. As well as contacting our top 60 biomanufacturers, in fact, we contacted a number…