Biopharmaceutical contract manufacturing organizations (CMOs) were initially enabled when the requirement for a company to file for both an establishment license application and a product licensing application transitioned to the current format of a biologics license application (BLA) submission for biological products (1). The initial focus of such CMOs was to provide large-scale, commercial manufacturing for companies that had already developed and validated bio manufacturing processes. Consequently, CMOs were generally formed as stand-alone service providers that “rented” manufacturing capacity to their customers. Some of the earliest biopharmaceutical CMOs originated as spin-offs of product companies that had built excess capacity. Other CMOs remained within pharmaceutical companies as divisions that offered third-party contract manufacturing services using their excess biologics manufacturing capacity. The CMO landscape has evolved over the past three decades so that the collective biologics CMO market offers large- and small-scale manufacturing capacity for customer products at all stages of clinical development. Many CMOs are still partly or completely owned by pharmaceutical companies, but many “pure–play” CMOs that do not have products of their own also compete for manufacturing capacity and resources.

Another evolution in the CMO market over past decades was the increase in service offerings for development of production cell lines, manufacturing processes, and analytical methods. By offering “one stop” development and manufacturing services, CMOs can capture customers early in their product-development timelines and can retain those customers throughout clinical development and onto the commercial market if their products are successful.

CMOs are now providing more early development support to their customers as well as offering fully integrated services, including specialized services such as aseptic fill–finish. Growth of the full-service contract development and manufacturing organization (CDMO) market has enabled a paradigm shift from early biotechnology companies that wanted to become “fully integrated pharmaceutical companies” to today’s nimble, lean, and sometimes virtual companies. Such companies are effectively taking new product concepts into clinical trials and — after demonstrating proof of concept — finding willing buyers in the large pharmaceutical market. That is enabled by the ability of new companies to outsource all development work and move quickly from product concept into first-in-human studies. Large biopharmaceutical manufacturers are moving toward CDMOs for product development as well. At BIO 2015, Joanne Beck, PhD (senior vice president of process development at Shire Pharmaceuticals) indicated that her company “would like to outsource all gene therapy and mRNA replacement development until we have gone through successful phase 2–3” (2).

Projected Growth of the CMO/CDMO

Market A High Tech Business Decisions market report estimates that biopharmaceutical company outsourcing will grow from 16% in 2015 to 34% over the next five years, creating revenues of over US$4 billion. The study’s author explains this growth as “companies using biopharmaceutical CMOs because of their need for additional capacity, their need to access different capabilities than what they have internally, and/or their desire to establish a secondary supply for risk mitigation” (3).

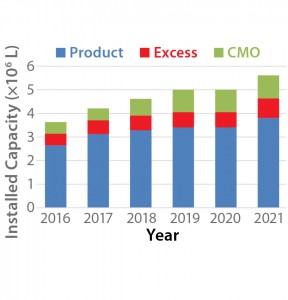

We have used BioProcess Technology Consultants’ (BPTC) proprietary bioTRAK database to estimate the growth trajectory of the biopharmaceutical CMO market. This analysis is based on the projected growth of mammalian-cell–culture manufacturing capacity and the percentage of this capacity that is currently held by CMOs. Although some service providers offer microbial manufacturing capacity, gene therapy, cell therapy, and other specialized services, the majority of current global manufacturing capacity is devoted to mammalian cell culture.

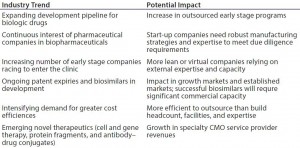

Figure 1 shows the projected growth of mammalian cell capacity through 2021. Our analysis estimates that overall mammalian cell culture capacity will grow from 3.6 million liters to 5.6 million liters, a growth rate of about 11% per year overall. However, growth in mammalian-cell–culture capacity for CMOs and for pharmaceutical companies using their excess capacity to provide CMO services is projected to be 13% and 21%, respectively, over the same period. Table 1 shows trends within the biopharmaceutical industry suggesting that the growing capacity will lead to increased revenue in the CMO market.

To respond to shifting biotechnology industry paradigms and current biopharmaceutical industry trends, CMOs have continued to move away from the business model of solely “renting” manufacturing capacity to one of offering extensive and differentiated development and manufacturing support. CMOs and CDMOs now offer a number of specialized, value-added services for customers with early stage development needs and those who require support to generate a BLA– enabling process validation data package. As the market for antibody–drug conjugates (ADC), cell therapies, and gene therapies has grown, CMO and CDMO markets have responded by offering specialized services in those areas. That strategic shift has led to service providers offering more vertically integrated suites of services, such as the following:

- proprietary cell line development technologies (mammalian or microbial) such as proprietary transfection vectors coupled with robust parental cell lines of known lineage that are optimized to grow in suspension and in media free of animal-derived-components.

- CDMO delivery of a cell line and master cell bank after receiving its customer’s protein sequence for a product, thus reducing development time and accelerating time to clinic

- improved analytical development and execution, including adding product characterization technology to support early and late-stage development.

- comparability studies (particularly for biosimilar products) that require use of different sophisticated orthogonal analytical methods and instrumentation to completely characterize complex molecules

- CMO technology and specialized capacity to produce ADCs (antibodies that are coupled to drugs that have systemic toxicity)

- specialized manufacturing processes and facilities for ADCs containing potent tumor chemotherapy agents (required to prevent the release of highly potent small molecules).

By providing specialized services to differentiate their offerings and capabilities, CDMOs would like to become indispensable partners to the biotechnology industry. Such integrated, specialized services enable greater flexibility and manageable cash flow than would be possible with an internal infrastructure.

Obstacles Ahead

As in any business sector, competitive pressures are causing existing CMOs to reevaluate their business models. Among the pressures reshaping this industry are

- sensitivity of the biotechnology industry to manufacturing pricing

- need to invest in equipment, technology, and expertise to offer novel services

- global supply chain demands

- competition among service providers located in different labor markets.

To differentiate their services, many current members of the CMO community are actively promoting their integrated development and manufacturing services by adding a “D” for “development” to become known as CDMOs in their target markets. Such efforts to become more vertically integrated are highlighted by a series of industry mergers and acquisitions:

- Catalent’s acquisition of Pharmapak Technologies, Redwood Bioscience, and Micron Technologies

- The merger of Patheon and DSM to form DPx, followed by its acquisition of Gallus Biopharmaceuticals

- Lonza’s series of acquisitions beginning in 2008, which included amaxa, Algonomics NV, Simbiosys Biowares, and Vivante GMP Solutions

- Pfizer’s PfizerCentreSource CMO services unit adding Hospira’s One2One CMO through acquisition

- The Polytherics and Antitope merger to become Abzena, followed by Abzena’s acquisition of Pacific GMPMerck KGaA’s acquisition of Sigma-Aldrich, thus adding media and cell line development to EMD Millipore’s Provantage Services CDMO

- Merck KGaA’s acquisition of Sigma-Aldrich, thus adding media and cell line development to EMD Millipore’s Provantage Services CDMO.

Services Differentiation Through Innovation

Biopharmaceutical stakeholders from investors to patients are pressuring the industry to reduce manufacturing costs at all points along the product development continuum. Yet the pharmaceutical industry is highly regulated, and patient safety is a primary driver of many early development costs. The drive toward a CDMO business model could lead to innovative solutions that address cost containment while helping to bring better products to market more efficiently (5). CDMOs that develop and reduce to practice advanced process and scale-up technology expertise are being sought out to realize measurable efficiencies and cost savings without compromising patient safety and product quality.

Speed to market and efficient use of capital will continue to be important factors going forward. In addition, competition from biosimilars and changing reimbursement policies are likely to put pressure on drug pricing. Those driving forces provide a stimulus for manufacturers to seek novel services through innovation. Innovation and early adoption by CDMOs are likely in several areas, including upstream and downstream processing.

Perfusion and High-Density Cell Culture Technology: Perfusion cell culture initially was developed to enable manufacturing of low-expressing, unstable biopharmaceutical products. Some early antibody production processes also used perfusion, but in time it was generally replaced with controlled, high-titer fed-batch processes.

Perfusion is now making a resurgence in the biopharmaceutical industry because it can now produce antibodies that are expressed at high levels. High–cell-density perfusion systems (100 × 106/mL) can be maintained in optimal conditions and operated for extended periods, resulting in higher volumetric productivity than traditional fed-batch manufacturing. Protein products are harvested continuously, enabling continuous downstream purification. For CDMOs, perfusion bioreactors are relatively small, with a smaller footprint than equipment for batch production, which reduces operating requirements. Further, perfusion technology is adaptable to a number of cell and product types, including vaccines, monoclonal antibodies (MAbs), and cell therapies (6).

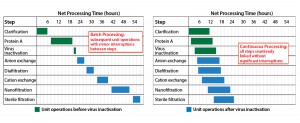

Figure 2: Timeline comparison between downstream batch processing (left) and continuous processing (right)

Downstream Continuous Processing: Downstream continuous processing — either alone or coupled to upstream systems such as perfusion culture — represents another opportunity. The complexity of coupled systems is likely to require unique expertise to operate within a regulatory structure that emphasizes a quality by design (QbD) approach to quality and safety. In a recent presentation, Howard Levine (founder and president of BPTC) challenged the audience to consider the impact of purifying 1 kg of MAb using less than 1 L of protein A column media in under one week through application of continuous processing (7). Figure 2 provides a timeline comparison between batch processes and continuous processes.

On a cost-per-batch comparison, using a continuous downstream process could reduce routine manufacturing costs by 35% and reduce clinical manufacturing costs by 66% (8). Innovative CDMOs offering perfusion cell culture with continuous downstream processing will differentiate their services (9).

Opportunities Ahead

Sponsor companies may contract with CDMOs that offer start-to-finish development and manufacturing reasons for logistical and economic reasons (10). Such services would begin with specialized cell lines and transduction systems, then go on to include clone selection, cell banking, and a complete suite of analytical services to thoroughly characterize a biological molecule. Those activities would be followed by comprehensive process development and characterization incorporating a complete QbD approach, followed by process validation leading to current good manufacturing practice (CGMP) production. Such full-service CDMOs offer a comprehensive set of services that connect all aspects of product development and production through to commercial manufacturing in an integrated process.

The CDMO services sector is on a growth trajectory. Factors driving this growth include an increasing number and diversity of biotherapeutics in pipeline development, demand generated by new healthcare markets, a goal to reduce costs through innovation, and the unrelenting pressures to be first to market.

References 1 Center for Biologics and Evaluation Research (CBER). Guidance for Industry: Cooperative Manufacturing Arrangements for Licensed Biologics. US Food and Drug Administration: Rockville, MD, August 1999.

2 Scott C. Speeding Development and Lowering Costs While Enhancing Quality. BioProcess Int. 13(8) 2015: S23–S25.

3 Stanton D. Bio-CMO Sect to Grow Over 40% on Big Biopharma’s Burgeoning Pipelines. Biopharma Reporter 15 Apr 2015; www.biopharma-reporter.com/Upstream-Processing/Bio-CMO-sector-to-grow-40-on-Big-Biopharma-s-burgeoning-pipelines.

4 Seymour P. Global Biomanufacturing Trends, Capacity, and Technology Drivers. Presented at DCAT Week, 14–17 Mar 14-17 2016, New York, NY.

5 Flyte G. Putting the “D” in CDMO with Advanced Process Development. Am. Pharm. Rev. Jan.–Feb. 2016, supplement.

6 Mahler G. Advancing Biologics Development and Manufacturing. Am. Pharm. Rev. January–February 2016, supplement.

7 Levine H. The Future of Downstream Processing. 2016 PDA Annual Meeting; 14–16 March 2016; San Antonio, TX.

8 Ransohoff T. The Potential for Continuous Chromatography and DSP in Clinical Manufacturing of Biopharmaceuticals. IBC’s Antibody Development and Production Conference; 28 Feb 2013, Huntington Beach, CA.

9 Walker N. Opportunities Abound for Contract Services in 2016. Am. Pharm. Rev. January–February 2016, supplement.

10 Husain ST. Strengthening CDCMs to Meet Industry Needs in 2016 and Beyond. Am. Pharm. Rev. January–February 2016, supplement.

Corresponding author Alfred Doig, MS, is publications manager, and Susan Dana Jones, PhD, is vice president and principal consultant at BioProcess Technology Consultants (BPTC); 1-781-281-1869; adoig@bptc.com; http://bptc.com.

Dear Sir or Madam

After Greetings

We are an Egyptian pharmaceutical company have the patent for lidocain new formula.

Inhaled dry powder lidocain spinhealr discohealr turbohealr and meter dose inhaler

And we pleased to cooperate with your company in licensing and marketing the new DPI dry powder inhaler formula in your country or any other countries as suggested by your strategy not in Egypt

AS we now licensing it in Egypt

Looking forward to hearing from you

Yours sincerely

Ahmed ELsisi

00201140520002

Skype viber google duo app imo