In many ways, patient-specific cell therapies (PSCTs) are still the “new kid on the block” in medicine. Researchers, therapeutic developers, manufacturers, regulators, and payers are still exploring and developing an understanding of the powerful benefits and unique challenges associated with this growing industry. As we all become more familiar with PSCTs, an evolution will need to occur — as it has for automobiles, computers, and every technological advance in human history — for these therapies to become widely adopted, cost-efficient, market-scalable, and sustainable over the long-term. From where we are now as an industry, what is needed from a manufacturing perspective for us to achieve a manifest future for patient-specific cell therapy?

Table 1: Differences between traditional biologics and PSCTs; product attributes in green, manufacturing design drivers in blue

Not Your Grandfather’s Medicine

From their compositional complexity to their mechanisms of action to their manufacture, PSCTs are very different from traditional biologics. Some key differences can be grouped into two categories: product attributes and manufacturing design drivers (Table 1).

Because of those differences, manufacturing PSCTs has inherent challenges not experienced with other biologics. For example, failure of a PSCT production lot does not just incur unreimbursable cost, but it means failure to treat a patient who was waiting for cells to be returned as therapy. With PSCTs, some errors can be life-threatening (delivery of the product lot to the wrong patient, for example). Furthermore, economies of scale are limited, and a separate batch record and lot release are needed for each patient. Having such complex products with properties directly influenced by their manufacturing process results in challenging comparability assessments and greater comparability risk when making process changes.

In light of those challenges, cell therapy developers must invest in robust manufacturing processes that make products of high quality at a reasonable cost of goods (CoG). Those processes need to be scalable and sustainable throughout the commercial life of each product. A strategy of planning for and implementing a manufacturing process that from the beginning takes into account quality, CoG, scalability, and sustainability is something we refer to as development by design (DbD). In essence, DbD requires planning for those four elements to take place well ahead of each phase of product development.

The Factory of the Future

To achieve optimal DbD-based manufacturing, the PSCT industry needs a manufacturing process that is vastly different not only from the traditional methods of manufacturing biologics, but also from even the current standard of cell therapy manufacturing. For the cell therapy industry as a whole to truly become commercially viable, we must envision and develop the “factory of the future” (Figure 1).

We need an industrywide effort in engineering and innovation, an effort that is just beginning to take root at suppliers and technology providers, small biotech companies developing cell therapies, and some contract manufacturing partners. Their efforts will enable thoughtful and staged rebuilding of unit operations for cell therapy manufacturing from the ground up, transforming manufacturing processes and test methods to achieve true scalability and business sustainability. Cell therapy manufacturing must move largely away from the cleanroom model to the “back of the facility” into areas more suited for high-volume production.

Cleanrooms certainly do have a place in cell therapy. However, automation, integration, and closed-processing systems can create a solution in which an entire clean room need not be dedicated to one process for one patient at a time. Then the company’s bottom line will be in better shape for the associated time, cost, and effort to put those systems into place. To make this vision a reality, the industry must strategically consider five crucial elements: comparability risk, cost of goods, automation and integration, business sustainability, and idle capacity.

Comparability Risk

When exploring the four drivers of commercial viability — quality, cost, scalability, and sustainability — a PSCT developer must consider the potential comparability risk and anticipate the implications of making changes after or during late-phase clinical trials to address them. As dictated by the US Food and Drug Administration (FDA), cell therapy developers must demonstrate that manufacturing changes do not affect safety, identity, purity, or potency. Depending on the nature of the change and product characterization results, a demonstration of comparability between pre- and postchange product might require only laboratory testing or could require additional clinical studies. Early in a clinical development program, a manufacturing process change does present comparability risk. But much less is at stake at that point than after substantial clinical data have been generated, when establishing comparability would be costly for the developer or even could require repeating a late-phase trial.

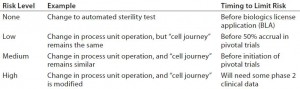

Some process changes have relatively low comparability risk, whereas others have relatively high risk. For example, changing a critical raw material in a core process step (e.g., transitioning from animal serum to serum-free culture media) would present a major comparability risk. However, the risk associated with switching from manual record-keeping methods to electronic record-keeping would be minimal. Risks generally are lower when changes do not alter the journey that cells take (Table 2).

Cost of Goods

Typically driven by labor and testing costs, the current high CoG of cell therapy products usually demands a sizable commercial value proposition. As processes mature, a company’s focus on CoG for commercial viability becomes critical. DbD encourages cell therapy developers to consider CoG at a phase-appropriate level throughout all stages of manufacturing. However, to truly understand and optimize CoG, a company must break down costs to a more granular level (as in the “Nuances” box). Once CoG has been broken down by unit operation, a cell therapy developer can make an informed decision about which unit operations would be best suited for optimization through automation and integration.

| CoG Nuances in PSCT Manufacturing |

| Direct Costs (broken down by unit operation): Direct labor (production, testing, QA, and materials handling), direct materials (production and testing), and third-party services (outsourced testing, shipping, cell collection, irradiation, and so on) |

| Indirect/Overhead Costs: Supervision, management; quality incidents; facility operations (cleanroom operation, maintenance/repair, utilities, rent); materials/service management; and sustaining technical support |

| Amortization of Nonrecurring Investments: Nonrecurring design, development, engineering, and validation services; capital expenditures (equipment, facilities) |

| Absorption of Failed-Lot Costs: Direct costs, indirect costs, and amortization of nonrecurring investments |

Automation and Integration

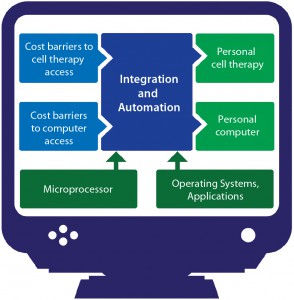

When personal computers were first introduced, the associated cost barriers were too high for them to be practical except in high-end science, academic, and finance settings that had true need and the money to spend on what would be considered luxuries elsewhere. High costs prevented computers from going mainstream at first, until automation and integration made their manufacturing processes efficient enough that associated CoG became reasonable (Figure 2). Now you have a computer in your pocket with more processing power than the machines NASA used to land men on the moon. Cell therapy is currently undergoing a similar transition.

Automation and integration are critical success factors for PSCTs. If you can simplify your manufacturing process through integration (fewer steps) and automation (reduced labor, reduced quality incidents, improved consistency), your benefits will accrue with every patient you treat. For instance, an hour saved in making a PSCT is an hour less of cost for each patient dose, whereas an hour saved by automation in traditional biomanufacturing is a benefit distributed over perhaps thousands of doses. The significance for PSCTs is much greater from a cost perspective. Automation strategies need to address a range of considerations:

- Process automation (closed-loop process control)

- Task automation (e.g., cellselection process, cell washing, and formulation)

- Test automation (e.g., compendial methods)

- Factory automation — information (electronic batch records) and manufacturing execution systems (MESs).

Business Sustainability

Good supply chain management can make or break the commercialization success of a cell therapy. PSCTs demand the highest quality ingredients that are tightly regulated, rarely bought off the shelf, often coming from a sole supplier. Therefore, those ingredients are very expensive. Both near- and long-term planning are essential for mitigating supply chain risk.

Procuring high-quality ingredients is the first hurdle that a cell therapy developer faces, and this alone can create supply and sustainability bottlenecks. Few providers can manage the burden of making products that will enable their customers to meet good manufacturing practice (GMP) standards, which is required for manufacturing clinical products. That limits the number of suppliers to choose from and creates a sustainability issue, which represents a major commercial liability. Market demand also causes shortages for smaller customers, such as cell therapy developers, when hospitals and other large or critical consumers are priorities. One example is the ongoing saline shortage caused by rising overall demand. Few direct actions can be taken to mitigate such problems, but overall market mindfulness and building good relationships with multiple suppliers can guide a company’s supply strategy. As the cell therapy industry grows, more suppliers will be willing to invest in the quality systems required to serve it.

Another example of a sustainability challenge comes with use of fetal bovine serum (FBS) for cell expansion. Given the current increase in the number of cell therapies being developed, it is conceivable that market demand for FBS (a byproduct of the meat and dairy industries on which cell therapy developers are thus dependent) eventually could exceed supply. That might cause prices to continue rising or even cause supplies to run dry. Clearly, having multiple suppliers and finding sustainable manufacturing solutions will be critical to the future success of PSCTs.

Cell therapy developers must actively seek out suppliers that offer innovative solutions. The selection process can be optimized through working with a specialized manufacturing partner that already has the right connections. Below, the advantages and disadvantages are described for different sizes of raw-material suppliers.

Traditional large suppliers of big pharma, blood banks, and academic researchers are most reliable as they begin dipping their toes into the cell therapy industry. Although vigilance is required, these suppliers can be counted on to understand the regulatory requirements (and sometimes the specific needs) of cell therapy. Many materials (especially the mainstays of biological processing) can be sourced from multiple suppliers, which makes larger suppliers the prime choice for such materials. Custom products such as particular tubing-set configurations and culture media in bags thus can often be procured and integrated early in a process. Although that can be expensive in phase 1, it minimizes the need for making subsequent changes later in development.

Many medium-sized suppliers with a significant percentage of their business with cell therapy makers are moving to meet industry demands. These are somewhat mature companies, each often with a flagship product line that fills a niche and is well-established in the industry. Such suppliers generally are knowledgeable about manufacturers’ needs and usually can provide a robust supply of products, although their scope will be limited. They also may be more willing to take risks on new innovations than larger players would be. CoG can be a scalability risk with manufacturers of this size, especially sole suppliers of critical products. Ideally, supply agreements should be negotiated early with them; insufficient supply from such providers can be expensive at best — and at worse, halt production.

Smaller companies generally are the most flexible (with their specialty products) and may be willing to work closely with you to make their products work. However, their knowledge of your needs will be much more limited. In such companies, quality systems may be lacking, validation often will be left entirely to end users, and (most important) business sustainability may be a problem. Few business catastrophes are worse than building products into processes only to learn a few years later that they no longer exist. Effective contract manufacturing organizations (CMOs) play an active role in partnering with nimble innovators but remain conscious of the fact that extensive testing is required before new technology can be adopted.

Considering your supply chain and mitigating risk early are crucial. Choosing high-quality ingredients early on requires up-front investment, but mature decision-makers build economy of scale into their processes and realize the value of doing so as production booms.

Idle Capacity

Cell therapy manufacturing requires a great deal of time, labor, and cleanroom space, which can burden CoG with the overhead operating expenses of idle capacity. Underused manufacturing capacity — technologies, people, facilities, and resources — drives CoG for delivery of an eventually commercialized product to unsustainable levels. Even the nascent cell therapy industry has already seen this demonstrated in the market. Generally, companies can address the issue of idle capacity though three strategies: distributing production, reducing cost, and sharing infrastructure.

Optimized Distribution of Production: With PSCTs, timing is everything. After cells are removed from a patient, shipping and timing of manufacturing are crucial. Once the therapy is ready, shipping and timing of that treatment back to the same patient is equally important. If apheresis takes place on a Monday, for example, then manufacturing and processing can take place only on Tuesday, Wednesday, or Thursday to allow time for the therapy to be shipped back to the patient and injected during business hours before the weekend. Because cell therapy product need to be “fresh,” PSCT manufacturing facilities can be left sitting idle several days a week — with overhead to pay. Cryopreservation may be one way to optimize such a process so that production can take place any day that a cleanroom is available.

Reduced Cost Elements of Idle Capacity: Even when production is optimized, some idle capacity will be inevitable. Here is where closed processing systems come into play. Although they won’t directly reduce the cost of any unit operation, a closed-processing strategy (and others mentioned in the “Factory of the Future” section above) will lower overall costs by reducing space and shortening time needed in cleanrooms. And that can make the total idle capacity cost more manageable.

Shared Infrastructure Across Multiple Programs: Under the current manufacturing paradigm, cell therapy developers must predict future market demand accurately and anticipate how much cleanroom time they will need to meet it. If a developer invests the time and resources in building its own in-house manufacturing infrastructure, then all time not spent using those cleanrooms (e.g., should the developer overestimate market demand) becomes costly idle capacity. By using a contract manufacturer, the same developer can invest only in the time it will need. Meanwhile, the manufacturing facility will be used at other times for other clients’ products. The responsibility for idle capacity and overhead costs will not fall on the PSCT developers themselves.

As the cell therapy industry evolves, idle capacity becomes one challenge that has not yet been considered adequately: No standard solutions are yet in place. But even if a product developer chooses to begin manufacturing in-house early on and then later wishes to transfer processes to a contract manufacturer for late-phase and commercial development, idle-capacity cost savings still can be substantial. And many developers are choosing to do that in today’s market.

You Can Get There from Here

For PSCTs, which present a great deal of clinical promise coupled with a challenging manufacturing profile, the journey ahead must follow a road less traveled. Getting there will require a comprehensive strategy for each cell therapy developer and for the industry as a whole. Solutions are expanding rapidly, but critical mass has yet to be reached.

As cell therapy developers move through the clinical product phases, they must not succumb to the tunnel vision of focusing solely on successfully completing a single trial. It is equally important to address long-term goals: What do you want your product to achieve, who is your target patient population, and is your current process suited to commercialization?

One way to keep an eye on the bigger picture is to define your manufacturing process in terms of DbD: quality, cost, scalability, and business sustainability. Using the expertise of a contract manufacturer that specializes in cell therapy can provide PSCT developers with the necessary insight to answer some tough questions early on so that together we can shape the future of regenerative medicine.

Brian Hampson is vice president of global manufacturing sciences and technology, and Jacob Ceccarelli is a biotechnology engineer at PCT (a Caladrius company), 4 Pearl Court, Allendale, NJ 07401; 201-677-2355; bdm@pctcaladrius.com, media@pctcaladrius.com; www.pctcaladrius.com.