Ruta Waghmare (director of worldwide emerging biotech market sales development in global pharma processing, Millipore Sigma), BPI Theater @ BIO, June 8, 2016 11:00–11:20 am

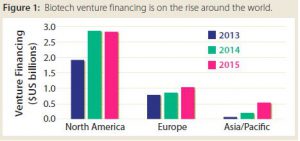

Millipore Sigma recently surveyed emerging biotechnology companies, defining those as companies with US$500 million or less in annual revenues. Such companies reported that one of their greatest challenges is attracting investors despite a rise in venture financing. In North America, the amount of funds involved in each financing round has increased, but the number of deals has stayed consistent. In Asia, both have been going up. It can be difficult for small players to obtain financing because of the increasing number of companies operating and preclinical molecules being developed. Between 2014 and 2015, the number of preclinical molecules in development worldwide increased by 17%.

Millipore Sigma recently surveyed emerging biotechnology companies, defining those as companies with US$500 million or less in annual revenues. Such companies reported that one of their greatest challenges is attracting investors despite a rise in venture financing. In North America, the amount of funds involved in each financing round has increased, but the number of deals has stayed consistent. In Asia, both have been going up. It can be difficult for small players to obtain financing because of the increasing number of companies operating and preclinical molecules being developed. Between 2014 and 2015, the number of preclinical molecules in development worldwide increased by 17%.

However, 82% of emerging biotech companies remain optimistic. They are planning to add production and development capacity. When asked to describe their main focus over the next five years, 47% replied that they are working on novel therapies (cell and gene therapies). Because they are more flexible than large companies, 23% said that they are adding facilities in emerging markets. The main risks they see in expanding to new countries include political and government issues, lacking knowledge about a given country or its culture, and questions regarding the ability or willingness of local payers to purchase their drugs. The risks that emerging biotech companies identified involve scale-up, supply/demand, intellectual property protection, and cost control. They will mitigate these risks by hiring consultants, enhancing internal capabilities, and engaging in local partnerships.

Many such companies are considering transfer of their developed molecules to larger companies. Millipore Sigma found that the earlier emerging companies transfer those molecules, the less revenue they will realize from them. It is best to wait until reaching phase 3. Emerging biotechnology companies instead can partner with suppliers such as Millipore Sigma, who can help them develop their molecules and hold on to them longer.

A year ago at the 2015 BIO Convention, Millipore held an executive summit with 40 emerging biotechnology companies. Then it found that their primary needs were related to funding and business partnerships, technical partnerships, and production of clinical batches. Millipore Sigma understands those needs and can help with all aspects of them.

“When it comes to product innovation, we’re seeing greater collaboration and partnerships with smaller companies,” said Waghmare. “Companies recognize that the majority of innovation no longer comes from inside the walls of large pharma.”

Listen to the complete presentation at www.bioprocessintl.com/BIO2016