India’s position as a global participant in small-molecule generic drugs, vaccines, and enzymes has been proven over decades. The country is one of the most populous and fastest-growing regions in the world, both economically and technically. But India’s potential as a biologics participant has not been realized. Its competence as a global biologics producer has not yet caught up.

India’s position as a global participant in small-molecule generic drugs, vaccines, and enzymes has been proven over decades. The country is one of the most populous and fastest-growing regions in the world, both economically and technically. But India’s potential as a biologics participant has not been realized. Its competence as a global biologics producer has not yet caught up.

Global industry concerns regarding the country’s position in the (bio) pharmaceutical industry haven’t changed much over the past eight years since my company completed its study, Advances in Biopharmaceutical Technology in India (1). Issues include political volatility, a desire for increased spending on domestic healthcare, intellectual property protection, and a need to develop India’s existing talent and education systems to meet the needs of biopharmaceutical technology segments. And India’s struggle to fully invest in innovative research and development (R&D) may be creating long-term gaps in the country’s progress.

Can India Fill the Gap?

In a recent survey of more than 100 biopharmaceutical professionals in India, my group identified specific, critical areas where India’s biomanufacturers recognize that they currently lack capabilities required to compete on the global stage. The survey also found where Indian companies are investing today in an effort to create a global biotechnology hub over the next decade.

Survey respondents exhibited substantial optimism. Indian biopharmaceutical professionals believe their country will fill the gaps: 100% of responding biologics companies indicated that their companies plan to target global good manufacturing practice (GMP) production within 10 years. Their universal recognition that global participation requires GMP competencies paints a black-and-white picture of how India must move forward to achieve success.

What Attributes Are Important Now?

To define what India must do today to achieve global success by 2026, the survey asked 104 qualified executives at Indian biopharmaceutical facilities to evaluate their domestic industry’s prospects (2). Over half (54%) of participants work at large-scale commercial biomanufacturing facilities; others work at contract manufacturers for biologics or at smaller biopharmaceutical companies.

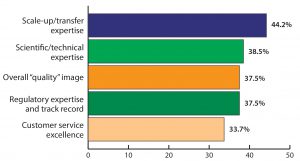

Figure 1: Top “strength” attributes required for India’s biologics companies to expand globally (selected responses from BioPlan Associates’ India Global Biopharma Center survey, June–August 2016)

Study respondents first identified their top five “strength” attributes most important to India’s chance of expanding its presence in global biopharmaceuticals. Of 17 attributes mentioned, the four most commonly cited attributes required by Indian facilities to compete globally included scale-up and technology transfer expertise, scientific and technical expertise, overall “quality” image, and regulatory track record and expertise (Figure 1). These top responses indicate that 44.2% believe that the Indian biologics industry requires greater scale-up and technology transfer competence and that the current shortcomings in ability to scale up and transfer from development to manufacturing may be inhibiting the Indian industry’s growth.

Interpreting India’s current self-image from those data suggests that over a third (38.5%) of Indian biopharmaceutical companies recognize major shortfalls in terms of their quality image and missing regulatory expertise. To establish themselves as global players, those companies recognize their need to improve these areas if they want to compete with commercial-scale capabilities elsewhere.

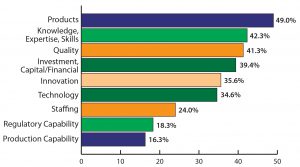

Figure 2: Top future attributes required for biologics companies in India (selected responses from BioPlan Associates’ India Global Biopharma Center survey, June–August 2016)

Attributes Needed for the Future

We asked respondents to consider strategically what India’s biopharmaceutical companies lack today and need to become competitive globally in a GMP environment (Figure 2). In this respect, India’s overall “quality” image becomes much more important and vaults to the top of the list. This mirror on India’s biomanufacturing shortfalls indicates that the community recognizes the critical nature of addressing quality factors. Top attributes became the overall “quality” image (with 41.4% of respondents selecting it as a top-five attribute); scientific and technical expertise (36.5%); audit results (34.6%); and timeliness, scheduling, and reliability (32.7%).

Those results indicate how Indian executives believe their facilities are failing to address the quality aspects necessary to compete on a global scale. It’s also important to note that those executives feel that improvements in timeliness and reliability will be critical. Other important attributes perceived by India’s biopharmaceutical community as needing improvement include commercial-scale capacity (31.7%) and regulatory track record/expertise (30.8%), along with speed of problem resolution, risk reduction and mitigation plans, and a more innovative biopharmaceutical pipeline.

Future Success for India Biologics

Domestic demand for biopharmaceuticals in India has been growing by various estimates — 15–20% annually — in part because of rising incomes and a growing middle class. As companies in the country ramp up operations to serve emerging domestic markets effectively, their growing expertise also will facilitate entry into Western biopharmaceutical markets.

Biosimilars are also beginning to play a role for India’s bioindustry development, with several large companies now manufacturing a few GMP-grade biosimilars that are approved for Western markets. Numerous Western multinationals are actively exploring opportunities and partnerships to expand into the Indian market, and biosimilars have emerged as a targeted pathway for the Indian biopharmaceutical industry to advance onto the world stage. However, although the country has expertise in generics and small-molecule drugs, that has not yet translated to domestically owned production of biosimilars (manufactured with GMP compliance). That is likely to change over time, however, as the Indian biopharmaceutical industry and its markets for biosimilars mature.

In the future, as India’s domestic biopharmaceutical markets expand and internal biomanufacturing and expertise ramps up, the current protectionism against foreign-originating drugs is likely to diminish along with the perceived need to nurture its nascent biologics markets. That will be necessary if the local industry is to compete globally. Price controls and generics-favoring policies also will need to give way to more global trade perspectives. Similarly, the challenging patent environment will need to shift, including cancellation of issued patents where local companies seek to manufacture generic versions. These changes will depend on the political situation in India. Such uncertainty affects the overall investment climate.

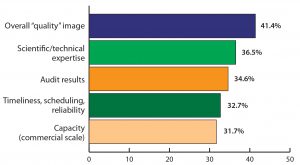

However, all that is well known by Indian biomanufacturers. They recognize that to expand globally, India’s local producers must address a number of critical attributes. In my group’s study, biologics manufacturers shared a broad array of elements that are currently missing in India’s ramp-up to becoming a global biopharmaceutical center. Topping the list and mentioned by nearly half of respondents was simply the need for marketable biological products (Figure 3). Typically, that refers to innovative drug products. Given the lengthy timeframe required to commercialize an innovative biologic — along with the lack of innovative R&D experience — a 10-year horizon seems too soon. Other achievable competencies noted as required by the Indian biopharmaceutical industry include knowledge, expertise, and skills; quality systems; capital and financial investment; innovation and technologies; staffing and production capability; and regulatory capabilities.

India’s Path to Exporting Biologics

Although India’s biopharmaceutical industry today is not focused on production of GMP-compliant biologics for export to the United States or European Union (with 81% of companies focused primarily on domestic production), the situation is changing. Fast-forward 10 years, and the focus will shift from domestic production to production for export: 100% of respondents agreed they would be focused on global production by then, with 91% also targeting domestic markets.

Respondents offered some additional comments on what will be needed for India to succeed as a top global biopharmaceutical center. Their remarks tended to focus on the need for greater investment in innovation and education:

- “India needs to invest in R&D to develop innovative products rather than biosimilars. Biosimilars can be a short-term goal, but developing and manufacturing low-cost novel drugs should be the area of focus to establish India as a top global biopharma center.”

- “India’s weaknesses include problems associated with quality management, perceived weaknesses around protection of intellectual property, inadequate financial support, and an unclear regulatory environment.”

- “Although Indian companies are well positioned to move ahead, rigorous quality control and regulatory compliance are needed to meet global standards.”

- “Adherence to CGMPs is nonnegotiable for India to become a global biomanufacturing leader. India also needs to be able to provide a host of capabilities such as fill–finish capabilities, as well as assay and product-characterization testing.”

- “Our style of working has been the same for many years. India needs be punctual in resolving matters, gaining knowledge, and dealing with other countries in terms of knowledge and upcoming technologies.”

- “Technological and commercial performance is low as indexed by the number of patents issued per unit of investment made in R&D. Realizing the potential and relevance to [domestic] society, India’s Department of Biotechnology has emphasized development of all facets of intellectual property rights with relation to biotechnology.”

- “India will require larger investments and effective innovation pathways.”

- “Indian regulations are being upgraded parallel to global requirements, which will motivate Indian companies to succeed in the global market.”

India continues to take small steps toward aligning with global GMP requirements. For example, the country’s drug regulators recently proposed to align its GMP requirements with World Health Organization (WHO) standards and eliminate the need for license renewals (3). However, harmonizing standards with WHO guidelines may establish the relatively less stringent WHO regulations over major-market GMP alignment. If Indian biomanufacturing regulations focus on distribution in India of generic products involving limited innovation, that could present a setback on the path toward internationalization. The country then could find itself competing with other, smaller developing countries — including those with more advantages to fill world demand for cheaper “biogeneric” products.

A Clear Vision of the Future

Indian executives clearly have their sights set on India’s becoming a top global biopharmaceutical manufacturing and (eventually) R&D hub. The country already is primed in terms of capacity. Currently, it houses 7.6% of global biomanufacturing capacity, according to the www.Top1000bio.com database (4), putting it close behind China (8%).

The Indian biopharmaceutical industry appears to have a realistic perspective on the long-term global opportunities in biologics. It also has rational expectations about needed investments in R&D, quality and regulatory systems, infrastructure, intellectual property (IP) reform, healthcare, and workforce development if it is to first meet the future needs of its domestic population before achieving a global position in biologics. Global investors and partners with the foresight to develop relationships and international companies that establish their own facilities in India today will share in the country’s future successes.

Related Facts and Statistics

| Since 2010, India’s 30% growth rate has flattened to a more sustainable ~15–20% annual growth rate (1). |

| Estimates of biopharmaceutical industry sales in India range US$2–4 billion in 2015. |

| The Indian biopharmaceutical industry amounts to only ~2% of the global industry compared with US and EU biopharmaceutical sales (~$200 billion), despite its nearly 30% of the global population. |

| Some analysts expect India to capture 10% of the global market for biosimilars over the next 10 years. But this will require major government invests in talent, infrastructure, education, and quality management. |

| The industry has a demonstrated, decades-long dedication to high-quality industrial-enzyme production and the ability to partner successfully with US/EU companies, including Novozymes and many others. |

| The Indian government plans to invest in increasing the number of biotechnology start-ups from ~500 to ~2,000 over next few years. Capital is facilitated by venture-capital funds including $147 million to support startups in R&D. Investment is reported to be targeting $2.7 billion by 2025 (2). |

| India’s healthcare spending is very low according to Deloitte, just 4–5% of its gross domestic product (GDP) (3). |

| The Indian government’s 12th five-year plan includes accelerating research, innovation, and development to become globally competitive (4). |

| India has targeted becoming a worldclass biomanufacturing hub by building a skilled workforce and leadership (5). |

| India is the number-one maker of recombinant hepatitis B vaccine (6). |

| References 1 A Biopharma Strategy for India: Vision 2020. ABLE–PricewaterhouseCooper Report, 2010.2 Biotechnology industry in India. IBEF (India Brand Equity Foundation): New Delhi, India, September 2016; www.ibef.org/industry/biotechnology-india.aspx.3 Dhawan A. 2015 Health Care Outlook: India. Deloitte: Mumbai, India, 2015; www2.deloitte.com/content/dam/Deloitte/global/Documents/Life-Sciences-Health-Care/gx-lshc-2015-health-care-outlook-india.pdf.4 Biotechnology. India Brand Equity Foundation: New Delhi, India, January 2016; ; www.india-opportunities.es/archivos/publicaciones/Biotechnology-January-2016.pdf. 5 Annual Report 2015–2016. India Department of Biotechnology, Ministry of Science and Technology: New Delhi, India ; www.dst.gov.in/sites/default/files/DST%20 2015-16.compressed.pdf. 6 Biotechnology. Make in India Conference, December 2014; www.makeinindia.com/article/-/v/make-in-india-biotechnology. |

References

1 Advances in Biopharmaceutical Technology in India. Society for Industrial Microbiology and BioPlan Associates, Inc.: Rockville, MD, January 2008; www.bioplanassociates.com/india.

2 Survey of 104 qualified executives at Indian biopharmaceutical facilities. BioPlan Associates, Inc.: Rockville, MD, June–August 2016; unpublished white paper.

3 India Proposes to Align GMP with WHO Standards, End License Renewals. FDAnews Drug Daily Bulletin 18 October 2016; www.fdanews.com/articles/178920-india-proposes-to-align-gmp-with-who-standards-end-license-renewals.

4 Concentration of Global Biopharmaceutical Manufacturing. BioPlan Associates, Inc.: Rockville, MD, accessed 7 October 2016; www.Top1000Bio.com.

Eric S. Langer is president and managing partner at BioPlan Associates, Inc.; 1-301-921-5979; elanger@bioplanassociates.com, www.bioplanassociates.com.