Since the 1986 approval of the first recombinant therapeutic antibody, OKT3, biopharmaceuticals have become a large percentage of overall pharmaceutical company revenue. In 2018, sales of the top five selling recombinant proteins — Humira (adalimumab, AbbVie), Keytruda (pembrolizumab, Merck), Herceptin (trastuzumab, Genentech), Enbrel (etanercept, Amgen), and Avastin (bevacizumab, Genentech), all antibodies — totaled over US$48 billion. The compound annual growth rate (CAGR) for antibodies revenue was about 20% from 2004 to 2014. Those products include naked monoclonal antibodies (MAbs), Fc-fusion…

Manufacturing

Evaluating Biosimilars: A View from the Small-Molecule World

For many years the pharmaceutical industry was dominated by small (usually synthetic) molecules, mixed with a number of nonactive materials and encapsulated or (in the really old days) rolled into pills or pressed into tablets. Although synthesizing the active pharmaceutical ingredients (APIs), formulating the dosage forms, and analyzing the materials at every stage of a product life cycle were not always trivial activities, they were relatively straightforward. Most of the tools needed for analyzing/controlling each step of the manufacturing process…

From Big Data to Precise Understanding: The Quest for Meaningful Information

High-throughput technologies have transformed the biotechnology industry. The amount of data they generate is at least a hundred times higher now than it was two decades ago, primarily because of the rise of “-omic” technologies. As in many other industries, the biopharmaceutical sector entered the era of big data the day that high-throughput analytics were routinely implemented in experimental research. Big data refers to “datasets with sizes beyond the ability of commonly used software tools to capture, curate, manage, and…

Ask the Expert: Accelerating Timelines By Integrating Cell-Line Development and Manufacturing

In a 31 October 2019 “Ask the Expert” presentation, Nicole Wakes (group leader of Abzena’s cell-line development team) observed that drug sponsors often outsource their early upstream activities to a few different contract research organizations (CROs). But that strategy can thwart short timelines and introduce regulatory and financial risks. Wakes described Abzena’s upstream approach, illustrating how partnering with a single, multicompetent CRO from cell line construction through manufacture can streamline workflows. Integrating cell line development and manufacturing in this way…

Ask the Expert: Developing Bioprocesses for Clinical Manufacturing Success

Biopharmaceutical companies need to make critical chemistry, manufacturing, and controls (CMC) decisions during clinical development of recombinant protein biologics and advanced therapies. In a 17 December 2019 “Ask the Expert” webinar, Nigel Shipston (director of program design at FUJIFILM Diosynth Biotechnologies, FDB) reviewed key aspects of selecting and working with a contract development and manufacturing organization (CDMO). He also highlighted important factors that should be considered during early stages of process development. Shipston’s Presentation The sheer magnitude of investment required…

Bioengineering for “Benchtop Clinical Trials”

Animal studies can be poor predictors of human drug response. Species-specificity of organs is a concern especially for the heart. Many drugs that enter clinical trials will fail ultimately because of unexpected cardiotoxicity. Drug developers would love to mitigate such risks through in vitro human cardiac testing, but human heart biopsy materials and donor organs do not survive well in a laboratory setting. Breakthroughs with human stem cells offer an alternative. It is now possible to take a simple skin…

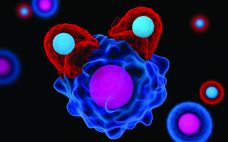

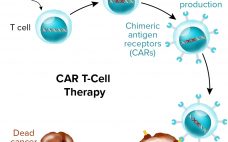

Challenges and Opportunities in CAR T-Cell Development and Manufacturing

Just about anyone in the biopharmaceutical industry will tell you that cost is now the primary concern in cell and gene therapy development. It hasn’t even been a decade since “manufacturability” was the main issue at hand — and cost has risen organically from related discussions. Regenerative medicine evolved from medical research rather than from drug-development companies, and technologies that worked in clinical settings haven’t translated directly to manufacturing facilities. Cost is often the problem. Early product successes (that ultimately…

Cell Banking for Cell and Gene Therapy: Regulatory, Ethical, and Scientific Considerations

Regenerative medicine holds great potential for human disease management, with hundreds of cell and gene therapy (CGT) products for tissue/organ reconstitution or replacement in different stages of development and clinical testing for toxicity, safety, and efficacy. For example, currently more than 60 CGTs have marketing authorization (although many with only conditional approval) from central regulatory agencies worldwide (1). Those products are treating conditions such as hematopoietic malignancies, immunological disorders, and cartilage disorders. Most of those treatments use culture-expanded autologous or…

Do We Need Separate Regulations for Advanced Therapies?

Before we had the 21 CFR 1271 regulation for tissue therapies, the US Food and Drug Administration (FDA) had determined that regenerative medicine was exceptional enough to warrant its own regulations for good manufacturing practice (GMP). Since 2001, the tissue industry has adapted to those new rules while the FDA stepped up enforcement over time. When a cell or tissue product is regulated under 21 CFR 1271, its specific regulations apply before the general regulations for biologics and drugs. But…

CAR-T at the Crossroads: Is Allogeneic the Way to Go?

As cell therapies move through the clinic toward commercialization, respondents to an Informa Connect industry survey are beginning to look to allogeneic — or off-the-shelf — products as “the next big thing.” Almost 200 people contributed to the Cell Therapy Analytics Report, revealing their current positions within the burgeoning cell and gene therapy space and offering their thoughts and predictions for the future. Most survey respondents work within companies developing oncology products. Of those, the largest group (41%) said that…