In the United States, up to 40% of businesses affected by a natural or human-caused disaster never reopen (1). The biopharmaceutical industry is not immune from disasters of a dizzying variety. But biotechnology companies often put all their supply needs in one proverbial basket. Companies need to understand fully the ramifications of contingency planning for single product lines. Imagine having to set up distribution and shipping plans for multiple products with different environmental needs, for shipping to different markets, and so on.

Contingency planning for business is important for dealing with high-profile events such as Hurricane Sandy. Business continuity planning will guide a company safely to the other side. But contingency plans are just that — plans — so they need to be made before something happens. Organizations need to ask difficult questions ahead of time so that they can be as prepared as possible to handle problems head-on. Begin with the basics (Table 1), and then get into as much detail as necessary to protect your company’s employees, investments, and reputation.

Table 1: Threat assessment for contingency planning at a fictional company using disposables and/or organic solvents in downstream processing and located in a US southeast-coast biotechnology hub such as North Carolina’s Research Triangle Park (XX = extremely high)

Risk assessment and management are the most fluid of planning tools, needed for every branch of a company around the world. Results will be unique depending on the possible risks and flexibility required to continue business with little or no interruption. What if your company has the best contingency plan, but a system is flawed even before that planning begins?

A Case StudyThat was the case for a medium-sized life-science company (“Company Z”) shipping valuable biological materials across the United States and around the world. After customer complaints, lost revenue, and temperature excursions that could affect patient outcomes and results, the company needed a fresh set of eyes to conduct a more thorough risk assessment of its logistical operations.

More was at stake than the company’s bottom line. Almost as valuable as its products was Company Z’s reputation. But product loss was costing about US$25–30,000 annually. After signing confidentiality agreements, the company invited Intelsius for a two-day site visit and evaluation of its shipping supplies, practices, and procedures.

Company Z’s number-one stated priority was to keep its products in the 2–8 °C range throughout their journey from the California headquarters to final destinations across the United States. Those same products also could be shipped to overseas facilities for distribution in Europe and Asia.

The International Safe Transit Association (ISTA)

ISTA is an organization focused on transport packaging. It pioneered the concept of package performance testing and certification >60 years ago; ISTA test procedures, standards, and certification programs are now at the forefront of responsible transport packaging. Organization members include shippers that manufacture and distribute products, carriers that provide the means of distribution, organizations that supply packaging materials and services, and testing laboratories that perform packaged–product performance tests.

Mission and Vision: ISTA develops and delivers standards, tools, and educational programs for the economic, social, and environmental optimization of packaging systems. It wants to see all packaging systems designed and certified to ISTA performance and environmental standards.

The organization helps its members control costs, lessen damage, and improve resource use during the distribution of packaged products by

-

Creating and publishing packaged-product test procedures

-

Certifying packaging laboratories, packaged products, and professionals

-

Providing education, training, and support.

For more information:www.ista.org/forms/ISTABrochure.pdf.

After a brief facility tour and visit to the shipping department, Intelsius began its assessment. Here are a few of the questions we asked: Are shipping components and systems ISTA qualified (see box, next page)? Are they regulatory compliant for carriers used in Asia, Europe, and the United States? Does Company Z have stability data to support its need for product to be shipped at 2–8 °C? Does it have appropriate facilities and equipment to ensure that products and components are prepared properly for shipping? Are staff members properly trained in the dozen steps for packaging those products using current systems? And why are there a dozen steps?

Having a clear strategy for distribution of temperature-sensitive materials is critical to ensuring that a product is delivered to patients in optimal condition. Working with a temperature-controlled, regulatory-compliant packaging designer, manufacturer, and distributor will allow several factors to be considered early in product development. Some suppliers may offer appropriate off-the-shelf options, but product-specific factors may require customized solutions. Risk assessment and strategy development begin with a few vital questions:

-

At what temperature does your product need to be transported and stored?

-

Where does the drug need to go — international or domestic market(s)?

-

During what season(s) will the product be distributed?

-

What stability data are available?

-

What are the size, mass, and dose format of the drug?

-

How is it packaged?

-

How much of an investigational medicinal product (IMP) can each intended site receive and store safely from a single shipment?

Data Gath

ering: After addressing those simple questions, you can move on to the next step in risk assessment: route mapping. Four types of data may be gathered for temperature mapping: actual data, averaged data, percentiles, and worst-case scenarios.

To gather actual data, transport multiple placebo and real-product shipments on the actual routes to be used. During those processes, explore key factors such as seasonality, deviations from standard operating procedures (SOPs), and adverse exposure frequency occurrences.

The averaged-data methodology reviews location-based sources such as historical temperature data to develop a temperature route map. In this case, it is important to review global coverage and seasonality.

The percentiles methodology reviews anticipated minimum and maximum temperatures of a specified percentage of shipments.

With a worst-case methodology, you can map routes that are expected to have the most extreme exposures. The problem with collecting data based on worst-case scenarios, however, is that results can lead to over-engineering of packaging solutions for many shipments. And this is where Company Z was just guessing.

Let the Testing Begin: The company uses three different-sized boxes, depending on payload, to ship its products to medical and surgical clinics and hospitals around the country. Ten sites — from Minnesota to Texas and California to South Carolina — were chosen to receive (and notified of) the test shipments.

During testing, to eliminate the possibility that failures occurred only on certain routes, universal serial bus (USB) data loggers were inserted at a specific position in each shipping container. The containers were sent priority-overnight by the two major shipping companies the company routinely used.

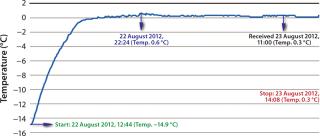

Even though Company Z had a shipping manual in place, all 10 test packages experienced temperature excursions in the 24-hour test period. Improperly prepared (and sometimes leaky) gel bags were often placed directly next to the payload, so the product would experience freezing (–14.9 °C) and never reach the 2–8 °C desired range (Figure 1).

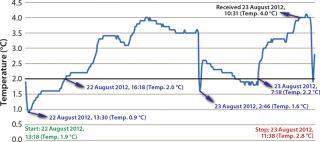

Cold Shock: None of the test packages experienced temperature excursions that took them out of range on the warm side. But the data loggers showed that each experienced fluctuations that were not apparent to the client on the receiving end of the package (Figure 2).

Company Z had instructions for preparation of the gel packs but had performed no scientific testing to determine the quantity of packs to be used for each size of the three boxes. The formula for deriving gel-pack recommendations appeared to be based solely on geography and how long each shipment was expected to take. Smaller boxes were recommended to contain one gel pack, medium-sized boxes three, and large boxes four. Domestic shipment time estimates were based on next-day or two-day-only delivery. International shipments were allotted up to 2.5 days. There were no instructions for considerations among shipping routes in extreme temperatures or for dealing with unintentional delays.

Past gel-pack failures had resulted in Company Z placing each pack inside a plastic bag and securing it with a twist tie before placing it in the low-density expanded polystyrene (EPS) container with the payload. Such a container could allow damage during shipment because of the low-density EPS. The lids were gasket-free, requiring additional shipping-clerk labor. The clerks had to tape each container’s base and lid before placing it inside its outer packaging.

Those may seem like minor details, but as in manufacturing processes, each wasted step or component costs a company money over the long term. Choosing a temperature-controlled solution was no more costly to Company Z than was its previous system components. Standardizing pack-outs for each shipment shaved 30% off the associated workflow process. With new solutions in place, a more thorough, comprehensive facility assessment will guarantee that future shipments do not fail before their journey begins.

Improving the Bottom LineCompany Z is considering all its options before switching to all temperature-controlled, regulatory-compliant packaging for the future. However, it has replaced one shipping route with an off-the-shelf solution from Intelsius. Since then, not one package has failed during shipments between the California headquarters and Company Z’s distribution facility in Europe.

Risk assessment and contingency planning are valuable company assets, but being realistic is the most important factor. No amount of planning will protect a company’s reputation if its proverbial car is missing a wheel before ever leaving the driveway. Most companies move quickly to correct the issues. Not only were Company Z’s revenues previously lessened by product losses due to packaging system and component failures, but the company’s reputation was being damaged too. And those annual losses were likely to discourage potential repeat business. Switching to a simpler, more efficient, temperature-controlled shipping solution will improve both aspects of the company’s bottom line.

Author Details

Stuart Davidson is manager of operations for the Americas at Intelsius LLC (a DGP company), 7696 Zionsville Rd, Indianapolis, IN 46268; 1-317-452-4006;