Defining the optimal market entry strategy for a vaccine is challenging. Worldwide, vaccine markets are commoditized andvery heterogeneous. In addition, with growth and evolving technology, the business model in the vaccines sector is changing. From the traditional vaccine model, constituted mainly of pediatric vaccines used to prevent a well-known series of viral and bacterial infections in large cohorts of healthy patients, we are seeing the emergence of a more pharma-like model that has been stimulated by new technologies, innovation, and growth. This new model involves higher R&D expenditure, a primary commercial focus on developed countries, and premium prices.

The vaccine market was estimated at US $16.3 billion in 2007 and is growing fast with an expected compound annual rate of 13.1% during 2008–2013 compared with 6% for the rest of the pharmaceutical sector. The recent approval of Sanofi Pasteur’s meningitis vaccine (and its release of six other inoculations including one for bird flu) illustrates the potential impact that vaccines can have, with sales for Sanofi Pasteur forecast to double to 15% of their anticipated total of €35.9 billion, or $52.4 billion by 2011. Some single vaccines are forecast to yield sales on par with blockbuster drugs and account for 60% of predicted 2012 vaccine sales, such as Prevnar (Wyeth) and Gardasil (Merck). With such growth, creative market-entry strategies are of increasing importance and, if successful, can result in significant rewards.

COMSTOCK IMAGES (WWW.COMSTOCK.COM)

Vaccine developers have historically focused their efforts on large developed markets, including the United States, European Union, and Japan. Despite the ongoing attractiveness of those markets, they are becoming progressively more saturated, with intense head-to-head competition in many key indications. As governments worldwide commit more funding to vaccine procurement, and increasing GDP allows for more disposable income for private healthcare spending, a truly global vaccine market is emerging. Thus the huge potential of emerging markets makes them an attractive growth target in both pediatric and adult vaccines, and entry into those markets is worth serious consideration.

Defining the best strategy, knowledge of possible approaches, and an intimate knowledge of the markets are key factors that characterize success. Part one of this two-part article focuses on a global view of strategies for market entry and provides insight into features of some emerging markets. The second part, to be published in an upcoming BioProcess International issue, will go on to examine strategic priorities for companies and innovations that could help speed up getting their vaccines to the market.

Strategic ConsiderationsGauge Feasibility: Begin by gauging market maturity and entry feasibility addressing the following questions:

-

Will the vaccine be accepted on the market? Is the epidemiological situation favorable to the introduction of such a vaccine?

-

Will the vaccine be available in sufficient supply?

-

Will the country’s population have access to the new vaccine candidate across the country?

-

Can the country’s healthcare system afford it?

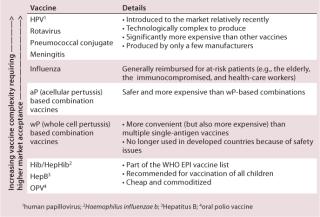

Market maturity is a subjective assessment, but a more objective parameter is the types of antigen already present on the market as vaccines. These are included on the national immunization schedule and they give a picture of the maturity and therefore accessibility and acceptance of the public market (Table 1).

Table 1: Market acceptance according to the type of vaccines included in the national immunization schedule (Source: Bionest Partners)

Vaccine acceptability is highly dependent on the epidemiological evidence available and the value proposition. Accessibility depends on established infrastructures and procurement mechanisms in the country — centralized access through tender, networks of hospitals, or numbers of private pharmacies, while availability is linked to the ability of a supplier to produce the vaccine in sufficient amounts. Last but not least, affordability can vary significantly and can be offset at times by public reimbursement agreements, for which a sound value proposition is required.

Add Value: To succeed in a market where local manufacturers are likely to be striving, new entrants should seek to provide a feature that will add value to existing vaccines. A solution for traditional vaccines such as diphtheria or polio is to develop combination vaccines with antigens that are not produced by local manufacturers. For instance, selling a DTwP-Hib (for diptheria, tetanus, whole cell pertusis and mophilus influenzae b.) vaccine where local manufacturers cannot produce the Hib vaccine will capture parts of the DTwP market in which the combination vaccine is used to protect against Haemophilus influenzae b.

Another alternative is to offer a new delivery method, proven efficacy improvement, or different mechanisms of action. An example is MedImmune’s FluMist live-attenuated influenza vaccine, which differentiates from the traditional trivalent inactivated vaccines. Intranasal delivery further adds to its unique selling proposition when compared with existing influenza vaccines on the market today.

Build a Strong Value Proposition: Once you’ve obtained market authorization, you need to accompany that with a sound value proposition to justify the added benefit of a new vaccine to stakeholders, whether in the public or private sector. We strongly recommend a cost-effectiveness study involving key private or public stakeholders to demonstrate the added value of the vaccine, both in public health and economic terms. Often the impact of such studies can extend beyond the country level to other areas in the same region. For example epidemiological data gathered in Brazil could be applicable to other Latin American countries.

In some cases, such studies can lead to modification of the recommendations for the vaccination of a certain population group, a substantial upside for any new product positioned with unique features and efficacy for that particular indication. The importance of involving relevant national or international regulatory and scientific bodies — such as the EMEA and EISS for influenza in Europe — and experts from national vaccination committees, health authorities, medical communities, and payers cannot be overemphasized.

Enter the Private Market First: Determining an entry strategy into the private market, although highly country specific, is the recommended first step in entering a new market because it allows a greater degree of flexibility. It is also somewhat easier than going directly head to head with public reimbursement issues. You can achieve this through direct sale, private insurance companies, or the corporate sector.

Do You Have What It Takes? Direct sales may not be the easiest thing to do in any market. Whereas some countries have relatively straightforward supply mechanisms and distribution networks, some of the most attractive remaining markets in terms of sales opportunities may prove much more difficult to access (e.g., India).

Demonstrate Benefit to Insurance Companies: All insurers in the private sector can decide to include a new vaccine in their service offering (in exchange for a small premium to their subscribers) if enough evidence has been gathered. In countries where not-for-profit insurance schemes exist, they will be specifically attracted by the potential of an extended immunization scheme as a mechanism to reduce other health costs. Not-for-profit entities will likely show more resistance toward vaccines with a high premium. Because they are funded solely by the contribution of their subscribers, inclusion of expensive services or vaccines is considered very carefully. The process of gaining approval for inclusion on insurance cover of a given vaccine also can be long-winded because of the requirement for approval from an insurance board or healthcare committee. To be worthwhile, you would be wise to target these stakeholders when you have a long-term objective for your vaccine.

Profit-based private insurance companies — or insurance underwriters whose assessment of their subscriber’s risk profile is closer to actuarial fairness — will make faster decisions to include a vaccine in their offering and are therefore better suited to a short-term access with faster return on investment. Moreover, they are more likely to accept premium-price vaccines, those not on the public schedule, or vaccines considered a lower public health priority because of the competitive advantage the organizations will gain by offering additional services to their subscribers. An example is Merck’s HPV vaccine Gardasil, which was first reimbursed by profit-based private insurance companies in France before its reimbursement was generalized to the public sector and other insurance companies.

Be Creative, Target Corporations: Besides insurance companies, corporations offer a unique and attractive way to access the private segment, but they require a more creative approach. In some countries, vaccination through corporations, provided a vaccine is licensed in the country first, is extremely well developed. Examples are varied and include Canada, Malaysia, The Philippines, Argentina, Mexico, and Brazil. In Brazil, corporate vaccination is even offered to the immediate relatives of employees and reimbursed up to a previously agreed price, sometimes up to US $35 for a flu vaccine, a significant mark-up to ex-factory prices.

To successfully penetrate the corporate segment, a vaccine manufacturer should be ready to share the investment risk during the first vaccination season to convince the client company that such investment is worthwhile. By monitoring absenteeism in employees and gathering company-specific epidemiological arguments in favor of its product, you may secure a more robust position for subsequent years. Providing a service to corporations — rather than solely a product — is a key success factor that can result in higher prices than if the vaccine is sold alone. This is especially true for influenza vaccination, as shown by the example of Sanofi Pasteur, which appointed key account managers to develop client vaccination portfolios and coordinate monitoring of the impact of vaccination. This package model enabled the company to price its service at $25 per employee rather than $7 per shot for the commoditized vaccine.

Expand to the Public Market with a Proven Track Record: The public segment is the most difficult to access, but in many vaccine markets it can also have the highest rewards. Because it is harder to access, you might want to tackle it last, after you have acquired field experience in the various private segments.

Seize Every Opportunity: Combination vaccines may capture market share from existing vaccines, but premium-priced and innovative vaccines can also succeed given appropriate demonstration of added benefits with the right stakeholders.

Value Proposition and Cost-Effectiveness Studies Are Key: Access to centralized public markets may be through regional tenders — e.g., Spain’s 18 regional autonomous communities’ health departments, Italy’s 192 local health agencies, or Canada’s 10 provinces and three territories — or through national tenders — such as in Mexico and Brazil — that will guarantee delivery to all points of vaccination for the eligible population. In other types of markets where the logistics are not centralized, such as France, you may need to devote greater sales and marketing resources to deliver vaccines to pharmacies or hospitals.

Whatever the market type, when you are dealing with public health providers it is particularly important to demonstrate the public health value of your product to ensure that it receives consideration alongside other public health priorities. For example, in some Spanish autonomous communities, as much as 60% of the grade granted to new vaccine candidates in a tender is dependent on price, with only the remaining 40% reflecting the technical dossier and clinical features.

To overcome this hurdle and give your product the best chance of success, you may first need to use clinical evidence to lobby for the acceptance of the vaccine among medical societies, who will be key stakeholders, along with key opinion leaders who are advisors to the relevant authorities. You might also consider partnership with advocacy groups. Before Prevnar became mandatory for all infants in Dubai and Abu Dhabi in January 2007, Wyeth was very active in government lobbying and education of local doctors and pediatricians on the benefits of their vaccine. Prevnar is now included on the national vaccination schedule for the whole infant cohort and is sold to insured patients at a price higher than in the private US market.

To optimize success, once you have gained support from regional authorities and the time has come to enter a tender process, consider a cost-effectiveness study in the region. Creative solutions include providing vaccines to gather data and demonstrate the benefit of the product as compared with other vaccines previously used. Once the value of the product has been demonstrated, this will undoubtedly secure a place for subsequent years in the vaccine supply scheme of the payer. Public health technical assessing committees could even decide to include it in their recommendations for the selection of future tender candidates.

Explore New Options: In growing markets with high governmental control over vaccine sourcing, such efforts may not be sufficient. In countries such as Brazil, where some vaccines intended for the public market are sourced exclusively from domestic-focused producers, different entry strategies may be required.

Leading vaccine developers have used technology transfers in countries such as Brazil and Mexico as a preferred way to access the larger public markets. Such agreements typically occur over a finite period of time, with a gradual transfer of knowledge and technology from an originator company to a domestic vaccine manufacturer of choice, with potential for extension. There may be variation in the structure of such deals, but in general they take place in a three-step process.

First, vaccines are bought in bulk from the originator company, relabeled, and then tested locally by the domestic vaccine manufacturer. The originator company needs to provide training to local resources at this stage. Next, vaccines are fill-finished by a domestic manufacturer: The product is sent in bulk to the local partner, who adds an excipient if necessary, fills the vials, and sterilizes them. The filled vials are then quality-controlled locally, labeled, and sold. Finally, part of the technology is transferred to the domestic manufacturer, who will subsequently produce the vaccines locally, going through each step of the production process. That latter stage is likely to require the local manufacturer to build a plant. If there are delays, the originator may benefit from an additional revenue stream during the building period.

Once a technology transfer is completed the originator receives a royalty revenue stream based on volumes produced. At each stage, the parties need to agree on how many volumes will go to market, the retail price, and the royalty rate paid back to the originator company.

Examples of current technology transfers include GlaxoSmithKline with the Foundation Oswaldo Cruz (Fiocruz) and Sanofi Pasteur with the Butantan Institute in Brazil. Sanofi Pasteur has also signed a deal with the Mexican Biologics and Reagents Birmex for a pandemic flu vaccine for which Birmex received grants from the WHO and the Mexican government to build a dedicated plant. However, those examples were products of their time. Although they serve as models, they may not suit every company’s needs. In the future, technology transfers might evolve toward more collaborative models in which both parties contribute to the development of a new vaccine.

You might also consider direct negotiations with governments. For example, Wyeth supplies their Prevnar vaccine directly to the government of Mexico. The company initiated large marketing campaigns several years ago, and Prevnar was included on the national immunization schedule for its whole target population in late 2006.

Developing Markets of InterestLatin America: With a population of around 412 million, very well established private vaccine segments, and busy national immunization schedules, Latin America is an attractive market for innovative vaccines. Brazil and Mexico offer the largest potential because of their sizes and healthcare resources; they also act as regional leaders and influencers. Although the Brazilian private market for vaccines is relatively small — less than 20% of the total market — it is well established with a number of private vaccination clinics, pharmacies, and private doctor’s practices. However, as John Anderson (a former GSK executive in Mexico and Brazil) points out, “The general public is neither very aware of, nor proactive about getting vaccinated with new vaccines, partly because of the excellent coverage of vaccines on the national immunization schedules, and partly because of affordability issues.” In general, the Brazilian public is not very focused on preventative medicine. You must, therefore, emphasize raising awareness and educating the public on the benefits of a new vaccine while targeting the more affluent private segment of the market for early acceptance.

Government influencers and the focus on local production are two key factors you should consider in developing strategies for accessing the public segment in Latin American countries. Technology transfer agreements with local vaccine manufacturing institutes and investment in local production facilities can be considered because they not only address the above issues but also act to decrease production costs and increase vaccine manufacturing capacity.

Eastern Europe: Having recently emerged from the grim political and economic situation of the past two decades, Eastern Europe is a nascent market where long-term opportunities for innovative vaccines exist. Because most of the population in Eastern European countries is concentrated in large cities, this market is easy to manage with only a few key account managers. The private market for vaccines is almost nonexistent because of prevailing affordability issues. Indeed, private healthcare is a relatively foreign concept and because of historical precedence, the general population expects healthcare, including vaccines, to be free or heavily subsidized. Nonetheless, the public markets are rapidly developing. Because the majority of these countries have aspirations to be or have recently been granted EU membership, government efforts reflect a desire to emulate the national immunization schedules of Western countries including procurement from prominent manufacturers. Brand and credibility are therefore important in this market, and if you hope to enter it, you would be well advised to establish a local presence through private market sales or acquisition of a local player, thereby securing solid market positioning for the future.

Middle East: Sweeping healthcare reforms have recently been undertaken in many Middle Eastern countries, particularly in Saudi Arabia and the UAE, respectively the largest and most influential markets. Most of these vaccine markets are public and vaccines are procured centrally through the governments and ministries of health. These markets are relatively closed to foreign entrants so very close collaboration and partnership with the government is required to demonstrate long-term interest and secure a favorable position. The emergence of the entertainment industry — such as hotels, artificial ski resorts, and seven-star hotels — is opening a number of private corporate market opportunities that may prove easier to access.

Asia: Hong Kong and Singapore are consumer-driven, healthcare-aware markets where access is rapid. FDA and EMEA regulatory approval decisions are recognized, and brand differentiation is very important. Acceptance in selected hospitals, particularly in Hong Kong, can act as a catalyst to uptake in mainland China.

Opportunities in China and Taiwan are mainly in the private sector, constituted of 250–300 million people living in the 150 most populous cities. Navigating the regulatory and distribution system in China is very challenging. Dr. Pierre Morgon, formerly vice president of international marketing at Aventis Pasteur (now Sanofi Pasteur) points out, “Having a local [distribution] partner to get across the red tape is absolutely necessary.” A number of vaccine producers have invested in manufacturing facilities in China, thereby increasing capacity and building a more established local presence.

Japan and South Korea differ from the rest of Asia in that they have separate regulatory and approval systems and are extremely closed markets where a local-partner presence is crucial but not necessarily sufficient for market access.

Russia: The spectacular economic growth of Russia during the past few years has translated into increased out-of-pocket and government healthcare expenditure. An affluent middle class located in a handful of large cities represent the private segment opportunity. Reforms in the public healthcare system are finally heading in the right direction and offer opportunities for reimbursement, particularly for more expensive medicines.

Sunny Uberoi of Antigenics, an American company that recently had its Oncophage therapeutic kidney cancer vaccine approved and launched in the Russian market, describes the company’s experience: “The Russian regulators were very open to simple, bureaucracy-free communication, making the approval process rapid and smooth.” Antigenics is hoping that its $40,000–60,000 per patient per year therapeutic vaccine will be reimbursed by the Russian government’s funding program for high-tech medicines. Russia represents an appealing market where smaller manufacturers can launch their innovative vaccines and larger vaccine developers can expand through both private and public market sales.

India: The fragmented nature of the market in India poses one of the largest hurdles for access. Being one of the most populous and fastest growing countries in the world, India offers unrivalled — yet tricky to unlock — opportunities for innovative vaccines in its private segment. The expanding middle class is increasingly aware of Western standards for medicine and is willing to pay high prices. However, building a distribution network is a difficult task. In the experience of Dr. Morgon, partnering with one of the local vaccine manufacturers or with a local pharma company, even during the vaccine development stage, allows access to an existing sales, marketing, and market access network.

In India, partnerships for development and manufacturing of vaccines also can help companies overcome some national reluctance attributed to a sentiment that India is used as a “trial-run” before launching a product in more developed markets.

The above-mentioned regional market analysis illustrates the importance of the strategic and tactical choices that must be made when choosing to expand or enter existing pockets of growth. Although less mature markets are attractive and have benefits, they also hold significant hurdles, making it crucial to understand the options available and make well-informed decisions. These choices obviously depend on each company’s objectives and will vary depending on the nature of the company.