Enthusiasm in the United States over opportunities for biosimilars has waned since such products were first launched in Europe. The hesitation stems from confusion and uncertainty surrounding regulations. Manufacturers and suppliers are looking for guidance from the US Food and Drug Administration (FDA), which has promised guidelines that are still in process after five years. Even naming protocols for biosimilars are clogging the works. And in the absence of coherent FDA guidelines, many US states are haphazardly implementing laws concerning biosimilars. But the stakes are high, so many commercial decision-makers, insurers, and policy strategists continue to waiting for specific guidances from regulatory authorities before they move forward.

The US Senate recently pushed the FDA to release guidance documents on biosimilar drug approvals (1). In August, a group of senators wrote the US Department of Health and Human Services about implementation of the Biologics Price Competition and Innovation Act (BPCIA), which was enacted in 2010 to encourage the FDA to create a framework for reviewing and approving biosimilars. Although the agency just recently accepted the first biosimilar application for review (from Sandoz), it has not released specific guidelines. This delay has heightened concerns in the industry about just exactly how biosimilars will affect patients, insurers, drug companies, and even suppliers.

BioPlan Associates has researched the biopharmaceutical industry for 25 years. We find that some 20% of the ~4,500 biopharmaceutical candidate products in the current pipeline (>900) are follow-on biopharmaceuticals — mostly biosimilars (>650), but also biobetters. We predict that only a relatively small percentage will make it to the market (2). With as many as eight biosimilar candidates in development for each reference product, competitive and technical factors are likely to decide winners and losers. Smaller, underfunded biosimilar manufacturers may find themselves at a disadvantage.

Confusion remains over factors such as prices and discounts for biosimilars (relative to long- established reference products). Resolution of those issues also may determine the general success or failure of biosimilar products in the United States. Competition will involve multiple biosimilars that sooner or later will be competing for each major reference-product target as well as other products intended for the same indication. In addition to actual biosimilars — those products approved through a formal biosimilars regulatory mechanism involving rigorous analytical and clinical testing to prove biosimilarity — there are already about 200 “biogenerics” (by regulated country standards) circulating in lesser-regulated international commerce.

Global Biosimilars Situation

The global market for biosimilars remains small and underdeveloped, with the United States not yet involved. To date, nearly all development has been in Europe, with smaller biosimilar markets developing in Australia, Japan, and some other highly developed, highly regulated countries. The current global market for biosimilars remains far short of projections made five years ago, with only about US$500 million in sales. That amounts to about 10% of the market for just a single major targeted reference blockbuster product (≥$1 billion/year). With more than a dozen biosimilars currently approved in the European Union, the average market for each such product is trivial by most standards. Despite biosimilars having been approved there since 2006, most European countries have moved slowly in adopting them. Overall, in European Union and other countries, biosimilars are priced at about a 25–30% discount relative to their reference products.

But the biosimilars markets are only just beginning to open. The nearly 40 blockbuster recombinant protein reference products and more than 60 others with sales of $0.5–1.0 billion are all prime targets for biosimilars development. Most of those reference products will see their patents start to expire in the next couple years. At that point, a flood of biosimilar applications can be expected.

Healthcare Policy Models

For many reasons, often involving politics and some countries’ centralized management of their own healthcare systems, the EU experience with biosimilars market development may not be directly extrapolatable to the United States. Uptake and adoption of biosimilars in Europe has been slow, with Germany the only country where they are capturing a significant market share from innovator reference products. And that is partly because government regulations there have established quotas for physicians, requiring them to prescribe biosimilar drugs.

European market development has been slowed by the diffuse nature of its market: 28 countries make up the European Union. EU biosimilar approvals must be adopted by each member state, along with guidelines implemented for their use and related insurance coverage. In addition, EU markets are further complicated by many countries controlling prices within more socialized healthcare systems. In this context, the EU experience in biosimilar market development is less relevant to the potential of such development in the United States, where the market is more competitive.

The Biosimilar Pipeline

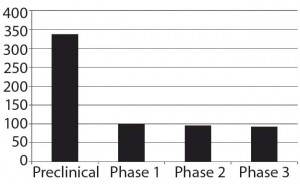

The development pipeline is relatively large for biosimilars. BioPlan databases track more than 650 candidates in development, with another 450 biobetter programs under way (3). Like biosimilars, biobetter products incorporate much the same active agent as a reference drug but involve significant modifications. So they are regulated and considered to be new, innovative products of their own. Figure 1 presents the current status of biosimilars in development (those not yet approved anywhere).

As with most pharmaceutical pipelines, the majority of biosimilars and biobetters are in their early stages, not yet undergoing clinical trials. Nearly all are targeting the United States and other major markets. More than 300 companies worldwide are already involved, whether directly or through licensing/marketing agreements, and so on. Most of those working on biosimilars are either large, international (bio)pharmaceutical companies or small, new and foreign- based entrants. Few classic venture- capital–funded and other midsized biotechnology companies are involved in biosimilars, most of them instead targeting new, innovative products. Small-company biosimilar developers ultimately can be expected to license product marketing to larger, established marketers. So at least in terms of marketing, well-known major players are likely to dominate the US biosimilars scene (at least in marketing) for the early years.

US Market Evolution

Clearly the US biosimilars market will be different from that in Europe. Like generic drugs and other follow-on products, biosimilars will be priced at a discount relative to their reference products. Their uptake will be relatively rapid, with insurance companies and other payers expecting patients to use the less expensive alternative much as they do with generic drugs.

The United States is attractive because it will represent the largest single market for biosimilars, likely to surpass current European and worldwide biosimilars sales as the first few products capture market share. The US market is more open than that of Europe, with more aggressive competition and rapid market uptake for substantially discounted biopharmaceuticals. (Those discounts remain to be defined; estimates of pricing run from under 50% to 70% of the reference product prices.) The FDA still needs to implement a number of guidelines and regulations concerning biosimilar approvals. The lack of such guidance is causing many companies to move slowly in their biosimilar development, particularly waiting to start clinical trials for US approvals until the agency clarifies its own plans and expectations.

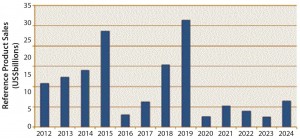

Figure 2 suggests a likely timeline for the economic impact of biosimilars introduction into the US market. It shows the cumulative 2013 worldwide sales of reference products beside their expected year of biosimilar launch in the United States (their expected patent expiration). Collectively, this shows that reference products with ~$100 billion in current worldwide sales soon will be subject to biosimilar competition. A wave of significant US market filings and launches can be expected to start in 2015, with another peak in filings and launches (patent expirations) about five years later, at the end of this decade.

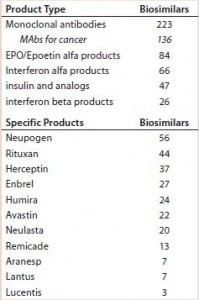

Table 1 lists the number of biosimilars in development for some major reference products and product classes. Essentially, all of those products will be targeting the US market. Even if just a portion of candidate products make it to the market, competition among biosimilars will be significant.

Competition and Questions About Profitability

Once the FDA provides appropriate guidances, biosimilar approvals should see an orderly flow, although patent disputes probably will arise following the pattern with generic drugs. Blockbuster reference-product manufacturers have substantial profits at stake, and the potential benefit of simply stalling biosimilar market entry for a single day would be worth pursuing. So legal battles are likely to ensue.

Although many biosimilars are in development, most analysts extrapolate EU market evolution to the United States, noting that it likely that only a few biosimilars, at most, will enter the market for each major reference product. Greater competition in the US markets probably will create pricing pressures. Large international companies — including current major biotechnology players such as Amgen and Biogen-Idec, most big pharmas, and large generic drugs companies as well as many foreign companies — already are developing biosimilar portfolios that primarily target the US market. Such companies expect to be long-term players in the US and world biosimilars markets, with most planning a portfolio of biosimilars and/or adding those to their current drug portfolios. For many new (including foreign) biosimilar developers, such products will provide their entry into the US and world biopharmaceutical markets, an opportunity they see as very attractive.

Big pharma, established biopharmaceutical, generic drug, new market entrant, and foreign companies all are planning to bring biosimilars into the US market. If that pans out, we can expect to see a very competitive biosimilars marketplace. To further complicate predictions, biobetters (improved follow-on products) and other products with the same indications all will be competing against each other. So competition could be fierce.

But reimbursement strategies still are being developed, and a key factor in how they turn out will be cost (whether biosimilars will be discounted relative to their reference products). Based on European experience, most experts have presumed that US prices will be discounted similarly by up to 30%. However, the US market is a larger, more unified, faster-moving, and more open and competitive market than that of Europe. Economics will drive rapid adoption of biosimilars in the United States, with insurance companies and other payers going for the cost savings that such products will provide.

Samsung Bioepsis is a joint venture of Biogen-Idec and Samsung for development and manufacture of biosimilars (with Merck & Co. involved for marketing). This major player already has announced its intension to launch biosimilars in the United States at a 50% discount. We believe that will be the standard discount on biosimilars for the US market. It is much less substantial than the ~90% discount common for generic drugs. With expected levels of competition, biosimilar companies will need to manufacture and market their products efficiently.

A number of biosimilar developers — including many foreign players — appear intent on getting their products onto the US market. In some cases, that could mark such companies’ first entry into the world biopharmaceutical markets. If they become more concerned with gaining approvals, expanding their market share, and building their portfolios, then maximizing profits from early biosimilar launches may not be a major concern for them. Such companies could be disruptive in the market.

Biosimilars will require marketing in the United States, unlike generic drugs, for which most branded- product prescriptions are legally or at least in practice routinely interchanged and filled with the alternatives. It seems unlikely that the FDA will adopt generic rather than unique names for biosimilars (4). The serious nature of the diseases that such products treat (and their still-high costs) will require biosimilars to be marketed, in many cases much the same as innovator products. That could include a focus on the quality and results of clinical trials.

One of the few universal predictions is that biosimilars will be profitable in the United States. With a market collectively worth tens of billions of dollars soon becoming available, some very attractive opportunities will arise for companies capable of manufacturing and marketing biosimilar products efficiently. But markets for most such products will be smaller than those of their reference counterparts. For example, AbbVie’s Humira antibody is on track for annual sales of ~$10 billion/year. Capturing just 5% of that market (~$500 million/year) would be profitable and is thus an attractive proposition. For companies with a portfolio of biosimilars or other complementary products that target the same indications, the US market will be both attractive and competitive.

Order Out of Chaos?

Not all of the many biosimilars currently at different stages of development can succeed on the US market. Confusion regarding the outcomes of their race to success will continue until guidance documents are finalized by the FDA, reimbursement policies are defined, and manufacturing costs are sufficiently reduced through efficient biomanufacturing technologies that help ensure profitability relative to legacy bioprocesses.

The US market for biosimilars will be chaotic at first, with competition among many new products and companies. Pricing remains debatable, but discounts as high as 50% are already being discussed. Companies that can efficiently gain approvals and implement the most efficient manufacturing will be profitable. Although biosimilar sales and profits will be much smaller than those of innovative products, companies that are “in for the long haul” will be among the winners.

References

1 Wolgemuth L, Jeffries J. Alexander, Hatch Call on Burwell to Immediately Release Guidance on Biosimilar Drugs. US Committee on Health, Education, Labor, and Pensions, 1 August 2014; www.help.senate. gov/newsroom/press/release/?id=d3a2624c-2410-4d08-b76e- 883592c3885a.

2 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production. BioPlan Associates, Inc.: Rockville, MD, April 2014; www bioplanassociates.com.

3 Rader RA. BIOPHARMA: Biosimilars/Biobetters Pipeline database; www.biosimilarspipeline.com.

4 Rader RA. Nomenclature of New Biosimilars Will Be Highly Controversial. BioProcess Int. 9(6) 2011: 26–33.

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989; 1-301-921- 5979; elanger@bioplanassociates.com; www.bioplanassociates.com.