The UK’s Centre for Process Innovation (CPI) will work with CDMO Cobra Biologics and vendor GE Healthcare to reduce the cost of making adeno-associated virus (AAV) vectors.

Funded by a £570,000 ($750,000) grant from Innovate UK, the three-way consortium is looking to increase the robustness and reduce costs for the manufacturing of adeno-associated virus (AAV) vectors to feed the growing gene therapy space.

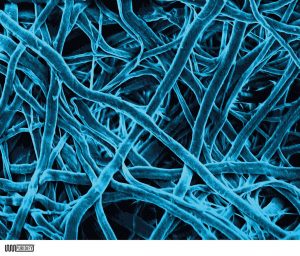

The collaboration will see each player contribute its expertise. GE Healthcare’s Puridify fibre-based chromatography technology platform will be used to develop a multistep purification process for AAV, while contract development and manufacturing organization (CDMO) Cobra Biologics will supply an end user perspective and scale up input.

The consortium will use GE Healthcare’s Puridify fiber technology.

UK-based technology innovation centre, the CPI, meanwhile will bring small scale expertise, a spokesperson for the consortium told BioProcess Insider.

The issues being addressed focus on the current complicated production processes used in the industry, which the consortium says risks gene therapies being launched commercially at prices unaffordable to healthcare payers.

“AAV not only has to be purified away from host cell impurities but also the correct form of the vector, the genome containing version, has to be enriched from empty forms,” we were told.

“The end goal will provide a scalable purification approach for AAV thus helping to reduce cost of these medicines via classic economies of scale and the ability to reuse the columns to further reduce cost of goods.”

Gene therapy capacity

There are only a handful of commercially avaialble gene therapies, notably Spark Therapeutics’ gene therapy Luxturna (voretigene neparvovec-rzyl) and the two chimeric antigen receptor (CAR) T cell therapies Kymriah (tisagenlecleucel) and Yescarta (axicabtagene ciloleucel) – which incorporate lentiviral vectors – approved last year.

However, there are more than 200 clinical trials underway and thus there is a demand for not only robust and cost-reducing platforms but manufacturing capacity itself.

A panel spoke about the lack of knowledge and a dearth of available capacity for process development, technology transfer, and cGMP production at the BioProcess Theater at the BIO International Convention in Boston in June.

Contract manufacturers are either moving into this space or expanding existing capabilities to feed the demand, including Cobra itself which committed £15m to expand capacity in both the UK and Sweden, set to come online mid-2019.

Other CDMOs investing in the space include France’s Yposkesi, Lonza, Brammer Bio, VGXI, Fujifilm, and Paragon Bioservices.