The complex and multiple parts of antibody-drug conjugate (ADC) manufacture means it is integral to choose a CDMO with mAb, small molecule, and bioconjugation expertise, say WuXi Biologics and WuXi STA.

The onslaught of ADCs is a hardy perennial in the pages of this publication and others when it comes to predicting the future of medicine. In 2011 when Adcetris (brentuximab vedotin) – then only the second ADC – was approved, it was predicted to be the watershed moment and the floodgates would open for more approvals and novel ADC approaches. But nearly a decade on, there are only nine ADCs on the market.

But there are signs that the ADC floodgates are about to open, not least the fact that five of the nine US approved products were approved in the past 16 months, but also the growing interest among Big Pharma firms.

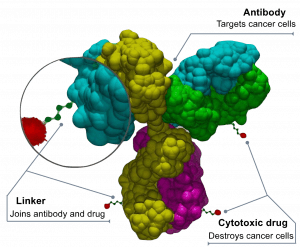

Image: By Bioconjugator – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=58772304

In the last month, Gilead Sciences acquired Immunomedics for $21 billion, entering the ADC space through the addition of recently approved Trodelvy (sacituzumab govitecan). Meanwhile, Merck & Co. entered a $1.6 billion with Seattle Genetics to codevelop ADC candidate ladiratuzumab vedotin.

Concurrently, the number of ADCs going through the clinic is increasing. According to WuXi Biologics “there are approximately 90 ADC candidates now in clinical development and well-over 200 in preclinical development.”

As such the contract development and manufacturing organization (CDMO) said it expects in the region of 20-25 IND applications for ADCs by the end of 2020, in line with the last two years where there have been around 18-20 each year.

“Part of the reason behind this surge in the antibody-drug conjugate space is that many of the new candidates have learned the lessons from difficulties encountered in developing those first-generation ADCs, and the second- and third-generation targets are proving much more successful and well-tolerated in vivo,” Chris Chen, CEO of WuXi Biologics – the company that handles monoclonal antibody (mAb) production and bioconjugation – told Bioprocess Insider.

However, challenges still remain as companies looking to develop such products must master not only development and manufacture of the mAb and bioconjugation, but also the linkers and complex and often highly-potent or toxic payloads.

“Such are the manufacturing difficulties that a remarkable 70-80% of ADCs under development are outsourced,” we were told, and the CDMO space has responded in due course through sizeable investments. WuXi Biologics and WuXi STA – the part of the ADC service responsible for payload / payload-linker development and manufacturing – have both invested in their operations, while other CDMOs such as MilliporeSigma, ADC Bio, and Lonza have all similarly expanded its ADC capabilities.

“Yet with increasing competition to access capacity from the best CDMOs and with the complexity of the supply chain that comes with any ADC, innovators, particularly smaller biotechs, are faced with difficult choices about how best to advance candidates through CMC development and into clinical trials quickly and efficiently while maintaining the requisite drug quality,” said Minzhang Chen, CEO of WuXi STA.

“Historically, the innovators were required to work with a minimum of three contract providers – one for the mAb, one for the payload (and potentially one more for the linker) and one for conjugation. The geographic proximity of those contractors is also unlikely, so innovators were faced with complex global supply lines. With more molecules now advancing towards clinical trials and commercial production, and the need to advance these molecules more quickly, this multi-vendor model is evolving. Increasingly, innovators are looking to work with CDMOs that can handle at least two or more stages of production to help streamline the transition between development phases and through the supply chain.”

WuXi AppTec, through its subsidiary WuXi STA and its partnership with WuXi Biologics, claims to offer the most comprehensive set of in-house capabilities in the industry to handle all stages of ADC drug development and manufacturing. This includes high potency (HP) API handling capabilities, antibody production plants, and a GMP bioconjugation and drug product filling and lyophilization facility.

“Since 2014, over 70 companies have taken advantage of this end-to-end ADC platform from concept through development and supply of all intermediates (mAb, payload and linker) and final drug product,” said Chris Chen. “The platform has supported 14 successful IND filings to date.”