Johnson & Johnson says it needs to invest in tech and capacity in areas like CAR-T as it looks to restructure its supply chain restructure.

J&J announced the supply chain restructure as part of its first quarter 2018 financials, telling investors the action would refocus resources towards “critical capabilities, technologies and solutions necessary to manufacture and supply its product portfolio of the future.”

The restructure will free between $600 and $800 million (€501 and €668 million) annually by 2022, though the firm will take a hit of as much as $2.3 billion to implement the changes.

Specific decisions on actions are yet to have been finalized.

Joining the CAR-T

Speaking to investors, CEO Dominic Caruso said he expects supply chain actions to include the expansion of “strategic collaborations” while reducing complexity, improving cost competitiveness, enhancing capabilities and optimizing J&J’s third-party network.

The program will also allow J&J to modernize and invest in new technologies, with Caruso naming chimeric antigen receptor (CAR) T-cell therapeutics as an area of interest for the firm.

“We need more of some newer technologies like biologics, like an investment in CAR-T for example. And we need less of the technologies that are related to some of the older parts of the portfolio,” he said (transcript here).

“So we need to advance our manufacturing footprint to have more capacity with new technologies, less capacity with older technologies.

“We’re going to do that from a position of strength, so that we’re ready when our plans materialize and our strategies to continue to launch new products that have these new technologies embedded in them and we want to be ready for that.”

Changes to the US tax system last year could allow J&J access to around $16 billion of overseas capital. However, speaking earlier this year at the JP Morgan Healthcare Conference in San Francisco, Caruso said his firm’s capital allocation strategy would not change.

J&J Manufacturing Capabilities

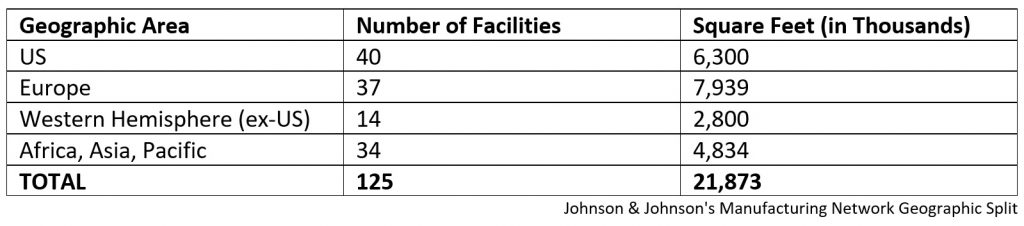

J&J has 125 manufacturing sites across all its divisions, according to its 2017 annual report. It also sources “from hundreds of suppliers around the world.” But while the firm’s Janssen has a large presence in biopharmaceuticals – with nine manufacturing sites for worldwide distribution of medicines and vaccines in the EMEA region alone – it has been late to the CAR-T party, and is yet to have its own in-house capabilities.

But while the firm’s Janssen has a large presence in biopharmaceuticals – with nine manufacturing sites for worldwide distribution of medicines and vaccines in the EMEA region alone – it has been late to the CAR-T party, and is yet to have its own in-house capabilities.

Under terms of a partnership deal last December, Janssen entered the CAR T space gaining access to Chinese firm Legend Biotech tech platform.