Orgenesis agrees merger with regenerative medicine company, gaining access to a commercial cell therapy, a COVID-19 candidate, and bioprinting technology.

The two companies have entered into a definitive merger agreement, which is expected to close by the year‚Äôs end. Orgenesis will pay $15 million (‚ā¨12.7 million) in shares of its common stock to Koligo Therapeutic‚Äôs investors to secure the deal.

Koligo possesses one commercially-available treatment, in the form of Kyslecel, which is an autologous pancreatic islet cell therapy used to treat chronic or recurrent acute pancreatitis.

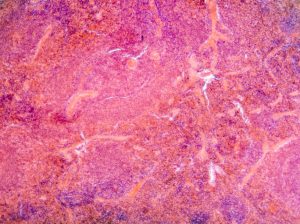

Image: iStock/defun

Kyslecel does not require pre-market approval from the US Food and Drug Administration (FDA), as it is produced and distributed according to the FDA’s current good tissue practises (cGTP).

The production of Kyslecel is managed through the isolation of pancreatic islets, with cells removed from a patient’s diseased pancreas and sent to Koligo’s FDA-registered facility in Louisville, Kentucky, where they are isolated and then shipped back for re-infusion into the patient’s liver.

According to Orgenesis, the biotech plans to accelerate the commercial scale up of Kyslecel in the US, as well as potentially into further markets worldwide.

Orgenesis also gains access to KT-PC-301, which is a potential treatment for COVID-19-related acute respiratory disease syndrome. The treatment is an autologous cell therapy and Koligo has completed a pre-investigational new drug (IND) consultation with the FDA to begin clinical trials.

A Phase II trial is expected to enrol 75 patients to determine the treatment’s safety and efficacy, subject to the FDA’s clearance of the IND application.

3D bioprinting

Beyond Koligo‚Äôs portfolio, Orgenesis also noted that it would gain access to Koligo‚Äôs 3D bioprinting and vascularization with autologous cells (3D-V technology), which would allow the biotech to create ‚Äėbiodegradable and shelf-stable‚Äô 3D cell and tissue implants.

The technology is currently being developed for diabetes and pancreatitis, but also has the potential for application in neural, liver, and other cell and tissue transplants, according to the company.

Koligo Therapeutics CEO, Matthew Lehman, explained to Bioprocess Insider how the technology works: ‚ÄúThe 3D-V bioprinting technology platform generates 3D cell/tissue implants that have been re-vascularised prior to implanting in the patient.¬†This approach allows for cells to be implanted in a tissue- or organ-like structure, rather than be infused where cells may not engraft successfully.‚ÄĚ

In regard to what advantages this holds, Lehman outlined that it offers faster re-vascularisation and inosculation of the cell or tissue transplant, while also improving host tolerance of the graft.

POCare business

Orgenesis plans to add the 3D-V bioprinting technology across its existing point-of-care (POCare) cell therapy platform, which the company noted is suitable for producing cell therapies at the point-of-care at a low-cost.

Vered Caplan, CEO of Orgenesis, described to Bioprocess Insider how the POCare business is made up of three components: ‚ÄúA pipeline of licensed¬†POCare Therapeutics¬†(to now include Kyslecel and KT-PC-301) that are processed and produced in closed, automated¬†POCare technology¬†systems across a collaborative¬†POCare network.‚ÄĚ

This network includes patients, doctors, industry partners, and research institutes and hospitals, allowing for the ‚Äėharmonised‚Äô clinical development and production of the therapies, Caplan explained.

Post-Masthercell expansion

After Orgenesis sold its cell therapy contract development and manufacturing organization (CDMO), Masthercell, to Catalent for $315 million, the company stated that it would use the funds raised to accelerate the development of its POCare platform.

Orgenesis followed this up with a joint venture alongside Revatis to offer muscle-derived stem cells to developers of autologous cell therapies through its POCare business.

Regarding further efforts to improve its POCare offering, Caplan said that Orgenesis is ‚Äėalways active‚Äô in its efforts to expand but nothing further would be made public.