Thermo Fisher’s $600 million CAPEX has got the trade press salivating. But similar statements, expansions underway, and continued demand mean this is just another day in the pandemic-fueled bioprocess space.

Yesterday, Thermo Fisher Scientific issued a press release to announce “more than $600 million in capital investments to expand its bioprocessing production capabilities through 2022.”

The firm said: “These investments are expected to more than double the company’s current manufacturing capacity and support biopharma customers as they ramp up to meet both the short-term demands related to COVID-19 as well as long-term efforts to develop new vaccines and biologics for other conditions.”

Understandably, the trade media jumped on this. $600 million is not an amount to sniff at. Moreover, the statement that more than 1,500 new jobs will be created across 11 manufacturing sites was greeted with superlatives, yet very few asked how these figure breaks down and, more importantly, whether this announcement is news at all.

While a numerical breakdown of the planned spending spree was not given, Thermo Fisher did say the areas of expansion would include manufacturing capacities for single-use technologies, chromatography resins, and cell culture media.

Double-digit growth and the COVID factor

The bioprocess space has seen continued double-digit growth for the best part of a decade. Even without COVID-19, there was no sense of slowdown in the industry as record numbers of biologics – plus new modalities like cell and gene therapies – whizzed through the clinic, driving demand for manufacturing technologies and consumables.

The ongoing pandemic has only increased demand further – those billions of doses of vaccines need to be produced somehow – and vendors such as Thermo Fisher have already reported COVID-19 windfalls. This is unlikely to abate any time soon.

Thus the $600 million mirrors CAPEX plans announced by other bioprocess vendors. Cytiva expedited $500 million investment plans last September, Repligen announced a $100 million capital expenditure plan, and Pall Corporation shilled out $114 million to increase capacity for single-use systems in January. The other major vendors, MilliporeSigma and Sartorius, too have invested in their production networks of late.

The overall figure is larger, but Thermo Fisher is large than its peers. In 2020, the company reported revenues of $12.2 billion and net income of $6.1 billion in its Life Sciences Solutions division. On these figures, Thermo Fisher’s CAPEX to sales ratio stands at around 9.8% – relatively high on its own but low compared to some of its peers.

Meanwhile, Thermo Fisher’s announcement may not be as clear as those reporting on it claim it to be. Without a breakdown site-by-site, it is unclear whether the capacity expansion at its site in Logan, Utah, for example, is the same as the extra 20,000 square feet of clean room space added late last year.

Finally, how Thermo Fisher separates its many businesses muddies the clarity when it comes to CAPEX investments. Its bioprocess offerings mostly fall under its Life Sciences Solutions division, though pharma services including its CDMO businesses fall under its Laboratory Products and Services division.

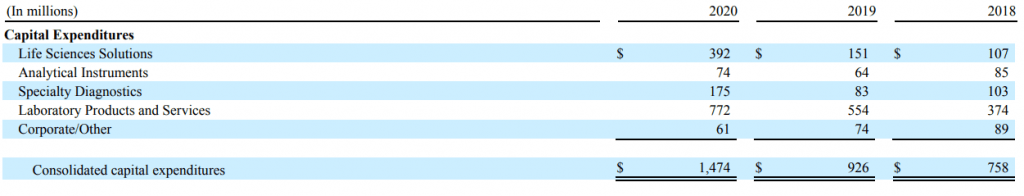

Thermo Fisher’s capital expenditure stands as follows for the past few years:

With that in mind, the $600 million announced this week – if it is earmarked specifically for 2021 and if it fits in the Life Sciences Solutions – is a significant jump from 2020’s $392 million investment. However, for a company with so many products and services in its portfolio, that has continued to see demand rise for its bioprocess services and technologies, and last year reported a $6 billion windfall from COVID, is today’s announcement that surprising?

Yearly announcement

About the same time last year, Thermo Fisher announced it was investing upwards of $475 million in new biopharma capabilities and capacity in 2020.

Again, the trade press regurgitated the declaration but the only new project announced was the planned opening of a cell therapy development and manufacturing collaboration center in Princeton, New Jersey. The rest of the CAPEX consisted of continued build out of capabilities ranging from biologics manufacturing, commercial packaging, QC capabilities, and fill/finish operations – all in the books.

And then seven months later, Thermo Fisher said during its third quarter it was committing an additional $700 million in CAPEX for the year. Yes, this was stoked by COVID-19, with global demand across all its services rocketing on the back of the pandemic, but it highlighted the ornamental nature of the previous CAPEX press release.