BioVectra Inc. is an eastern Canadian contract manufacturing organization (CMO) with expertise in both synthetic chemistry and biomanufacturing techniques. In recent years, it has obtained specialized knowledge in production of highly potent small molecules from fermentation and functionalized methoxypoly(ethylene glycol) products (mPEGs). The focus of BioVectra’s contract manufacturing business is the transfer and scale-up of processes for manufacturing its clients’ products under current good manufacturing practices (CGMPs) as appropriate for the clinical stage of each product.

In the current environment, CMOs play an increasingly important role in management of global manufacturing capacity. Growth of the contract manufacturing industry has been at least partially based on the premise that externalization of manufacturing can lead to more efficient use of global manufacturing capacity. More efficient capacity use lowers costs associated with manufacturing drug products and substances — and ultimately, makes treatments more affordable for patients.

A major contributor to this efficiency improvement is the flexibility CMOs have in using capacity. Consider the traditional model in which manufacturing capacity is added by a drug development organization. In that model, if a drug fails to meet its clinical goals, the company will be burdened by nonproductive capacity until it can develop an additional product that can use that capacity — or sell the plant. Therefore, CMOs can enable drug development organizations to use resources they have at their disposal more efficiently in pursuit of their core strengths: discovery and development of novel medicines to effectively address human health issues.

Virtual Companies on the Rise: Another major driver of growth of the CMO industry is the growth of virtual companies arising to manage assets resulting from academic research. These companies often lack the required expertise and/or capital, to establish a suitable manufacturing process to produce clinical material. In many cases, virtual companies do not want to bring their products to market, but to bring them to such a point that they can be sold to companies more experienced with the commercialization process. Virtual companies, therefore, rely on the CMO industry to manufacture their clinical materials.

Capacity Expansions in Support of Clinical Projects

A critical factor in determining whether a CMO is a suitable partner for a particular project is determining whether capacity is available to perform the various components of that project. BioVectra aims to have available capacity to address projects in early development stages. Determining capacity availability for commercial-scale requirements can be complicated when multiple projects using small-scale equipment are vying for the same large-scale resources. In some cases, a CMO may have capacity available at the scale required to supply a client with material for phase 1 clinical needs (small scale), but the CMO projects that it will not have the capacity to support that client’s projected future requirements (large scale). This does not necessarily disqualify that CMO from the project, particularly when the CMO has engineering resources available for design/construction/retrofit of facilities suitable for production of projected clinical requirements. This is, of course, contingent upon the CMO’s willingness to consider expanding to better support its customers’ needs.

Factors Affecting Risks in Capacity Expansions

Financing an expansion in support of a customer’s product can expose a CMO to significant risk. The degree of risk exposure depends on a number of factors, including project phase, customer commitment, and flexibility/versatility of capacity.

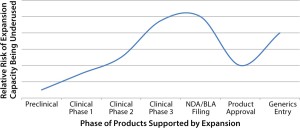

The phase of a project (preclinical, commercial, and so on) is not directly correlated to the anticipated risk of having excess capacity. Although early-stage projects are less likely to make it to market, there are often more projects in the pipeline that could fill the capacity a CMO intended to use. Therefore, having capacity to support early clinical-stage projects could be viewed as less risky than having capacity to support late clinical-phase projects. Upon product approval for marketing by the relevant regulatory body, the risk is greatly reduced.

The main sources of risk after approval are competitive products entering the market and the end of patent protection for the product being manufactured (Figure 1).

Customer commitment can greatly reduce the risk perceived by a CMO. If a customer guarantees repayment for the capacity over a set term, regardless of project progression, that can greatly reduce the risk perceived by the CMO. Any remaining risk, in the case of full customer commitment, would be associated with the perceived financial strength of the customer.

Another important factor that may influence risk is the flexibility/versatility of the capacity required to manufacture the product. If the capacity being added can be used for manufacturing a wide range of product types, it is inherently less risky than capacity that can be used for only one specific product.

Approaches to Financing Expansions

The mechanisms by which capital expansions in support of client production requirements are funded can be highly variable. The limiting factor is the creativity of the customer and the CMO. Both parties must be flexible in addressing one another’s concerns.

In some cases, the CMO may wholly finance the capacity expansion internally. In such instances, a customer will generally end up paying for the expansion either throughout the duration of the contract or over a set period. Alternatively, the client may finance the expansion. In such a case, the repayment generally would occur throughout the life of the contract. In some cases, a client that finances an expansion may seek to retain ownership of certain assets associated with it. In such a case, the repayment of that expansion is shared or reduced by the CMO over a contracted or set period of time. Risks are undertaken initially by either the CMO or customer. Both parties want their risks to be covered, and a number of traditional and novel measures can be implemented to share it.

Sharing the Risks: If a CMO finances an expansion, a clinical failure could result in idleness of the recently commissioned capacity. To fill that capacity, the CMO would need to engage another client and then perform technology transfer and scale-up activities, which potentially could leave the capacity idle for a number of years. That period could be reduced if the CMO, at the time of the failure, engages a customer for a project with similar capacity requirements.

Although a client may not be concerned about excess capacity at a CMO, the CMO will be. A measure to reduce the risk to CMOs, when internally financing an expansion, is a payout clause whereby, if a client’s project fails to proceed as anticipated, the CMO receives payment from that client in recompense for some portion of the expansion cost.

For a case in which a client finances the expansion, if a similar issue with project progression were to arise, the capacity would once again be left idle. Although the client might want a payout clause arranged inversely to that described in the previous section, that may not be suitable from the CMO’s perspective — because it would still be left paying for idle capacity. Under this scenario, assuming that the physical assets of the expansion are owned by the client until repayment occurs, the purchase of assets from the client could begin upon establishing a commercial manufacturing project and using those assets. Although this situation is not ideal for a client, risk is inherent when bringing a product through clinical trials.

Ideally, the contract manufacturing industry operates at a much lower risk and as a result, it tends to have a substantially lower return on investment for successful projects. Contract manufacturers have lower expected return on investment than drug discovery/development organizations. Consequently, CMOs expect that risk exposure should also be less than drug discovery/development organizations.

Case Studies

The following case studies present several recent and ongoing capacity expansions. Client identities and project information are presented anonymously in respect of confidentiality.

Project 0 — a Platform for Future Capacity Extensions: In 2000, BioVectra DCL arose as an independent division of Diagnostic Chemicals Ltd. (DCL). The diagnostic division (DCL) focused on formulation of clinical diagnostic kits and materials. BioVectra was focused on the synthesis and extraction of critical chemicals for diagnostic kits. BioVectra’s leadership envisioned expanding its commercial CGMP manufacturing capacity for active pharmaceutical ingredients (APIs). To realize that vision, the company designed and constructed a new facility over the next three years. It was designed with modularity in mind: The potential to expand capacity from the existing backbone structure was considered to be a critical design feature for the API manufacturing facility. The facility was commissioned in 2002 (Photo 1). At the time of commissioning, expansion plans were already under way to support establishment of a commercial-scale fermentation suite.

Case #1 — Installation of a Fermentation Suite for Manufacturing an Animal Health Product: BioVectra’s first extension of the API facility was to install a commercial-scale fermentation suite. In this case, the product to be manufactured was being marketed commercially before BioVectra was contacted about the project. At the time of BioVectra’s involvement, the existing supply chain for the product had been disrupted by regulatory action on the manufacturing site, leaving the customer without a source for its product. BioVectra was recruited to rapidly install a suitable manufacturing site to support the customer’s anticipated future volume requirements.

In support of this expansion, the customer provided a substantial portion of the required capital. BioVectra repaid the contributed portion of the capital over a fixed volume of product sold at a discounted rate. Resultantly, BioVectra retained ownership of the physical assets of the expansion after conclusion of the project (Photo 2).

Case #2 — Facility Addition to Support API Production: BioVectra’s next capacity expansion was substantially more ambitious than the first. The expansion was in support of a clinical-phase pharmaceutical product. In this expansion BioVectra secured financing through commercial borrowing against contractual guarantees from the customer. Under the terms of the contract, the facility cost was to be repaid by the customer over a designated period. This arrangement significantly reduced the burden of up-front facility construction costs for the customer. Further, under terms of the contract, BioVectra billed the customer on a cost-plus basis for development of the process and product provision. This protected BioVectra from scope-creep, while ensuring the customer that the service it received from BioVectra would be at a level of profit that both parties agreed was fair.

Case #3 — Retrofit of Existing Manufacturing Space for API Production: BioVectra’s most recently completed capital-expansion project was for manufacture of a biomass-extracted API. The customer for this expansion sought a guarantee of supply for its product, but it also required protection that excess capacity would not enable a competitor to reach the market.

Considering the relatively specialized nature of the process, finding uses for the capacity that would not encroach on the customer’s target market may not be possible. In the resulting arrangement, the customer financed the retrofit and retains ownership of the equipment. Upon completion of the contract term, BioVectra may purchase the equipment from the customer, or the customer will remove the equipment at its own cost.

Case #4 — Ongoing Negotiations for Capacity Extension: BioVectra is currently negotiating the terms of another capacity expansion to support the projected product requirements of one of its long-term clients. BioVectra’s intent is to internally finance a capacity expansion in excess of the client’s projected needs and to recoup a portion of the expense throughout a set period of supply, with any excess capacity becoming available for sale on the market. Considering that the client’s product has already achieved commercialization and is patent protected for a significant number of years, the risk associated with product discontinuation is minimal in comparison with a product currently undergoing clinical trials or one nearing loss of patent protection. The low level of perceived risk of product failure is a driving factor in BioVectra’s willingness to invest in a capacity expansion to support manufacture of the product.

A Creative and Consultative Process

Although BioVectra has used a diverse set of arrangements for financing capacity expansions in the past, it is likely that a scenario will arise in the future calling for an alternative solution to satisfy the needs of both BioVectra and its customers. Arriving at a solution that works for both the CMO and the client is a creative and consultative process. The negotiation leading to an alternative solution is an opportunity for both parties to better understand the capabilities and needs of one another. BioVectra considers its core strengths to be flexibility and willingness to adapt new practices to meet the requirements of any project taken on. Looking forward, the company will continue to aggressively pursue capacity expansions that support the manufacturing requirements of its clients.

Author Details

Clarke A. MacDonald is a technical and product support specialist at BioVectra Inc., 1-866-883-2872, x6224; cmacdonald@biovectra.com.