Biomanufacturing of human therapeutics is beginning a global transformation. New technologies, improved processes, the emergence of biosimilars, and growing worldwide demand for vaccines and biologic drugs to serve local populations are driving this transformation.

Over the next few years, diverse new markets will open, creating opportunities for a range of companies seeking to enter the field while putting pressure on established biomanufacturers to reassess their operating models. Many traditional barriers-to-entry in biomanufacturing are diminishing. Yet other challenges — including access to cell lines, support services, and a properly trained workforce — arise when developing an “in market, for market” biologics capability in many parts of the world. Here, we examine those trends and explore some best practices that are taking shape on the horizon of this evolving industrial landscape.

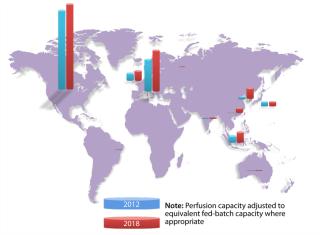

Since 1982, when Eli Lilly shipped the first approved recombinant therapeutic — human insulin produced by genetically engineered bacteria — the biopharmaceutical industry has been concentrated among relatively large Western companies. Today, 88% of global biomanufacturing capacity (as measured by total liters of installed cell culture capacity) is located in North America, Western Europe, Ireland, and the United Kingdom, according information collected by BioProcess Technology Consultants from publically available sources (Figure 1). High-cost, high-margin biologics are made in those locations primarily in massive, hard-piped stainless steel and glass production systems that have defined the state of the industry for decades.

That legacy is not surprising. It has been shaped by large capital requirements, high operating costs, and complex processes in traditional biomanufacturing plants. This has been an expensive business to launch and operate. It demands a highly skilled workforce along the entire development chain, from discovery and validated manufacturing processes to drug approval. And it relies on an advanced, stable infrastructure for ongoing support.

In recent years, the first generation of biomanufacturing has approached maturity, with new products flowing through established pipelines and revenue growth leading to overall industry profitability following decades of large capital investments. This maturity, or industrial homeostasis, however, is now facing significant evolutionary and global pressures.

New technologies, especially single-use production systems, are dramatically lowering building costs (and in many cases also operating costs) of biomanufacturing plants. Modular systems make it easier to produce multiple products in a single site, adding flexibility by significantly reducing lead times needed to modify a process for each new product. Such benefits are especially important for underdeveloped manufacturing processes.

Process improvements have increased productivity significantly more than industrial experts had predicted just 10 years ago, making the 2,000-L scale the workhorse for most biologics, including antibodies. The emergence of global biosimilars licensure pathways has widened opportunities for manufacturers that can leverage the technology and process advances of recent years to drive down costs and amortize capital investment over multiple products. Increasing standards of living around the world and the desire of many governments to have local vaccine and biologics manufacturing capacity to serve their populations is driving demand.

Such evolutionary pressures will expand biomanufacturing from its current concentration in the West to countries across Asia, Eastern Europe, South America, and Africa — specifically, China, Russia, Korea, Brazil, and Malaysia in the near term. Bioprocessing will migrate from large-scale single-product installations to smaller and more flexible multiproduct systems. The market will expand from products serving primarily Western countries and Japan to make products accessible to large populations in other areas of the world. It is an arc so similar to the evolution of the computer electronics industry that we now see Samsung entering the biomanufacturing space, making the bet that its well-established capabilities in the technology sector will give it an advantage.

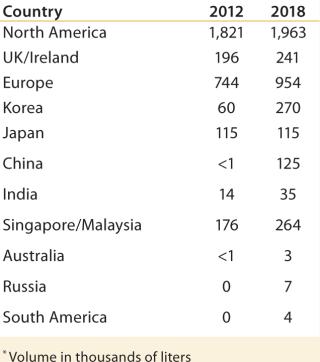

Building GloballyLooking ahead five years and considering projects that are now in various stages of planning or development, we expect that Asia and Eastern Europe will likely see the fastest growth in new biomanufacturing capacity (Figure 1, Table 1). We are also seeing significant interest in South America for manufacturing a range of biotherapeutics and in Africa for local vaccine production. Most growth will follow the above next-generation biomanufacturing model.

Table 1: Global distribution of cell culture capacity (graphed in

Scanning the landscape of the evolving global biomanufacturing industry, we see seven general categories of enterprises that are either considering or already moving to build biomanufacturing capacity in new geographies.

-

Large, incumbent biopharmaceutical and vaccine companies

-

Established midsized biotechnology companies

-

New contract manufacturers

-

New vaccine manufacturers

-

Government-backed initiatives focused on biodefense and local populations

-

Emerging biotechnology companies working on new drugs and biosimilar develop ment

-

Small-molecule companies seeking better margins by transitioning to biologics.

Given recent consolidations in the industry, many large biotechnolo

gy companies are moving quickly to cut costs and to simplify operations. They are planning to scale back their mega-production facilities in favor of smaller, more flexible plants that are built closer to global customers.

Established mid-sized biotechnology companies that have experience with both traditional and flexible single-use systems are well-positioned to move into many emerging markets, and many are planning to do so. With biosimilar-licensure regulations in place in Europe and on a path to being established in the United States, the number of new manufacturers seeking to capitalize on those pathways will grow. The same can be said for innovator companies such as Biogen Idec, which has entered into a venture with Samsung, the latter seeking to leverage existing biomanufacturing expertise.

In countries with nationalized healthcare, governments are the principal therapeutics buyers. Many such governments are getting involved with international partners to establish or incentivize construction of biomanufacturing capacity within national borders.

With the success of monoclonal antibodies (MAbs) and other biopharmaceuticals, some small-molecule companies that face dwindling pipelines and shrinking margins for existing products are making large investments in biologics research, development, and production. Players in each segment will have differing strengths to leverage and gaps to fill when planning to build a next-generation biomanufacturing site in an emerging market. As Figure 2 shows, access to technologies, cell lines, training, and expertise in process development and other key success enablers are not comparable across enterprises.

Table 2: Needs of in-market single-use technologies biomanufacturers*

In addition to managing those differing competencies, entrants to emerging markets will face many common challenges and opportunities, depending on the particulars of the location they target. For example, there are infrastructure issues to consider such as the reliability of the local power grid, potable water supply, and other critical utilities. The condition of — and freedom of access to — transportation systems (highways, bridges, airports, and so on) will affect the supply-chain stability. Political stability of local governments must be assessed. The scope and capabilities of local regulatory agencies will vary widely. Regional climates, especially in places of extreme heat and humidity, will have major impacts on processes, even when a production plant itself is tightly climate controlled. Access to a sufficient local labor pool, with training and sustainable workforce development programs nearby, is essential for long-term operations.

With so many variables in play, a company planning to build a biosimilars plant in Brazil will engage in a far different business development program than another company building a vaccine production plant in Nairobi. To help identify and mitigate risks early on in their business planning, it is essential for such potential entrants to engage in a thorough analysis of both its internal needs/capacities and external dynamics of their target location.

Case Study: Leading in RussiaAn instructive example of the evolving biomanufacturing industry is the research and development (R&D)program of the Russian company R-Pharm. It was founded in 2001 as a distributor of pharmaceutical products to hospitals and specialty healthcare centers across Russia. In less than 10 years R-Pharm grew to more than US$1 billion in annual revenue, supplying a wide range of products. The success of its distribution business has enabled this company’s strategic plan to build a fully integrated drug discovery, development, manufacturing, and distribution enterprise serving Russian and the greater Euro–Asian markets with small molecules and biologics.

The company is now expanding its large, modern campus in Yaroslavl, southeast of Moscow. The first phases of the campus have operational R&D laboratories, small-molecule processing with fill–finish capability. The next phase, construction of which is nearing completion, will be among Russia’s first biologics manufacturing plant.

R-Pharm is well positioned for such an effort. It’s an established, successful business employing top talent. The company understands the operations of a clinical supply chain, has established relationships with the Russian national healthcare delivery network, and has experience with good manufacturing practice (GMP) production and associated quality systems. It has access to excellent science, both in-house and through partnerships with leading universities.

In spite of those strengths, however, the company recognized that moving into biologics was significantly beyond its current expertise. Wisely, company leadership made important decisions early on in the planning that are helping to mitigate the risks involved in creating a biomanufacturing capacity.

Facilities and Equipment: Fundamentally, R-Pharm adopted a parallel development strategy, working with domestic and international partners to simultaneously advance the core elements of its biologics program. Through partnerships with entities in the United States and China, the company secured access to cell lines and technologies for expression of biological therapeutics, as well as subject matter experts to help them develop their own processes. R-Pharm engaged early with Russian regulatory authorities to work collaboratively on developing licensing processes and guidelines to help the government manage biologics at the local level and help build compliance into the overall design.

R-Pharm decided to build capacity based on single-use technology for many familiar reasons and selected the FlexFactory manufacturing platform from Xcellerex (GE Healthcare). That modular and mobile system went into production at Xcellerex’s Marlborough, MA facility; in parallel R-Pharm began the engineering, permitting, and construction for the building that would ultimately house its biomanufacturing operations.

Development of a traditional first-generation biomanufacturing plant would have progressed sequentially — site and design the facility, build out the core and shell of a structure, then fit it with utilities, and finally set the production system in place. Today, R-Pharm’s building and manufacturing platform are being developed at the same time in parallel. When the physical plant is ready, the FlexFactory system will be shipped in, already configured and validated at Xcellerex. After a relatively brief installation process, Yaroslavl will be ready to produce GMP products. This strategy is designed to significantly reduce time to clinic and market.

Training and Personnel: Furthermore, and perhaps most important, R-Pharm’s leadership focused early on the human capital needed for a successful biomanufacturing facility. After all, a state-of-the-art facility does not deliver drugs on its own. It is the qualified people working in that facility who reliably deliver drugs. Therefore, in parallel with the infrastructure development phases, R-Pharm has worked strategically to access experts as consultants to train its workforce, both for pro

duct launch and for development of its own pipeline for establishing a long-term workforce.

In the summer of 2012, R-Pharm sent six employees to work full-time in the United States learning biomanufacturing processes and how to operate and manage the FlexFactory platform. That core group will become leaders of the new plant in Yaroslavl and eventually help to establish training programs there to develop the local workforce.

The R-Pharm team was talented and smart, but they were trained in chemistry and had little experience with biologics at any process stage. Before they could plug in to Xcellerex’s significant training program, the first step for the R-Pharm team was to enroll in a “Fundamentals of Biomanufacturing” training program at Worcester Polytechnic Institute (WPI) in Massachusetts.

Founded in 1865 as one of the first technical universities in the United States, WPI has a long history of working with companies to develop educational programs that enable growth industries. For nearly two decades, WPI has partnered with biotech companies for bioprocess development projects and to deliver employee training programs in biomanufacturing and life-science business management.

The R-Pharm cohort graduated from WPI’s Fundamentals of Biomanufacturing course, which is offered through the university’s new Biomanufacturing Education and Training Center, a 10,000-ft2 facility that opened in 2013. The WPI center has large- and small-scale bioprocessing areas, support labs, and classrooms that are used to deliver customized, hands-on programs that provide a full range of education and training experiences to employees at every level of a biomanufacturing organization.

After WPI, the Russian group reported to Xcellerex’s facility in Massachusetts, where they began to learn the FlexFactory system, hands-on, using precisely the same equipment that would ultimately be installed in Yaroslavl. For nearly six months at Xcellerex, the R-Pharm group learned every aspect of the single-use production system. From there, Xcellerex arranged for several members of the R-Pharm team to work for several months at a third-party biomanufacturing company in the United States already using a FlexFactory to produce drugs. This added additional “real-world” operational experience to the R-Pharm team’s training.

Through late 2012 and into early 2013, R-Pharm also made effective use of Xcellerex’s contract process development and manufacturing services. So as physical construction of the Yaroslavl plant continued, R-Pharm employees and consultants worked with the Xcellerex team to develop processes. They produced early batches of product on a validated FlexFactory line in Marlborough that is nearly identical to the system that will be installed in Russia. Again, this parallel approach helps mitigate risk and speed time to clinic and market.

As of this writing, R-Pharm expects to have the FlexFactory shipped and installed in Yaroslavl in 2013. The same team of Xcellerex and R-Pharm personnel who have worked together for nearly two years will travel to Yaroslavl and lead the installation, commissioning, and validation of the plant through to the first GMP runs for the company’s lead products. WPI is also staying involved with R-Pharm — currently in discussions with the company to develop and deliver a range of training modules in Yaroslavl — for employees in all areas of the operation.

Looking AheadThe changes taking shape in the global biomanufacturing industry are not subtle or incremental. They will fundamentally alter the global playing field. The evolving industry will see many new entrants staking claims for various segments in regions not traditionally associated with biomanufacturing.

Overall, the economics of the industry look good. MAbs now dominate the list of top-selling drugs worldwide. Industry reports indicate that nearly half of all drugs now in development are biologics. There is resurgence in the vaccine sector for biodefense and for life-saving medicines to treat local populations. The advent of biosimilar licensure for drugs coming off patent protection adds a new and powerful segment.

Success in this new, globally distributed biomanufacturing industry will be a function of how well companies can leverage new technologies and manage the challenges of “in market, for market” manufacturing. Leaders who understand the dynamics of their target markets, plan early for the necessary infrastructure and support services, and develop a robust program for training of their local workforce will have the advantage.

Author Details

Corresponding author Irene Berner is the director of the Biomanufacutring Education and Training Center at Worcester Polytechnic Institute;