Single-use bioprocessing equipment has become well-accepted technology in a relatively short time. Disposable devices and components have created market niches and new segments that continue to evolve. In this dynamic environment, it is difficult to measure acceptance or assess market growth. Here we project the world market for cell culture single-use systems (SUS) as well as problems affecting that market, including adoption for commercial manufacture. This is based on our 10-year analysis of the industry, with data from our eighth annual survey report on biomanufacturing (1).

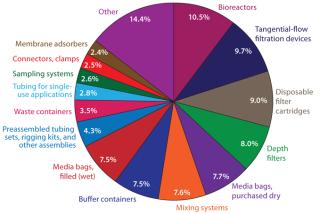

Complex SUS devices with unique attributes continue to emerge. The first single-use bioreactors — Wave rocker platforms (now from GE Healthcare) — entered the market just about 10 years ago. The disposable-bioreactor market remains dynamic, with new entrants and variants continually being tested as alternatives to stainless steel for commercial applications. Single-use technologies (SUTs) now make up a large percentage of small- and mid-scale biopharmaceutical manufacturing, particularly in clinical testing and research and development (R&D). Upstream SUT includes disposable bioreactors, mixers, containers, tubing, connectors, sampling systems, purification devices and columns, and probes/sensors. Almost all such equipment, particularly the critical parts that contact process streams, is composed primarily of various types of polymers (“plastics”).

Market value estimations and the number of devices sold are both moving targets. By now, the industry is well aware that SUTs provide many economic and other advantages over fixed stainless-steel systems, with companies on average spending about US$1 million/year on disposable equipment (1). Even assuming comparable overall costs, SUTs offer compelling advantages over stainless steel. Greater flexibility allows companies to buy and assemble systems as needed and store them on site for future use.

Those advantages have resulted in SUT capturing a majority of the market for new bioreactors in small-scale research and clinical supplies manufacturing. However, new disposable equipment needs to be purchased for each product run/lot manufactured. No matter the scale, even at ≥2,000 L, SUTs involve cycles of equipment one-time use, disposal and replacement. So although up-front, operating, and total costs are generally lower for SUTs than stainless steel, recurring expenses will be higher because of regular repeated purchases (whereas stainless steel equipment is purchased and installed once).

Although SUT dominates much of biopharmaceutical R&D already and is emerging in clinical-scale segments, biopharmaceutical manufacturing is currently dominated by mammalian cell culture capacity, use, and expenditures, especially for monoclonal antibodies (MAbs) that require repeated large doses. Currently, disposable devices have not entered mainstream commercial manufacturing, partly for regulatory reasons. When regulatory agencies approve broad use of plastic single-use devices, the total market for such devices will increase significantly.

SUT Market EstimatesThe world market for biopharmaceuticals is ∼$140 billion, which includes ∼$100 billion forrecombinant proteins — of which ∼$40 billion are for MAbs (2). Essentially all of that involves product manufacturing using stainless-steel bioreactors and other permanent equipment. Commercial (bio)-pharmaceutical development generally requires more than a decade; thus, SUT is still considered new technology for commercial applications. No major marketed biopharmaceutical products are yet manufactured using disposable bioreactors.

Table 1 lists some market estimates. The worldwide markets (expenditures) for bioprocessing facilities and equipment are estimated at $10.5 billion (or ∼7.2% of total biopharmaceutical sales). That is roughly split between up- and downstream bioprocessing. Industry consensus among vendors in our eighth annual report is that the overall bioprocessing market and its major niches will continue to grow at a steady 15–18%. That parallels the growth in marketed biological product sales.

Table 1: Disposables and related market estimates; the good manufacturing practice (GMP) market for single-use technology (SUT) today is estimated at US$150 million (for plastic tubing, manifolds, and connectors used with stainless steel systems)

An estimated 90% (4.7 billion) of the current upstream bioprocessing market involves stainless steel equipment, mostly large-scale (≥1,000 L) bioreactor-based systems used for commercial-scale manufacture. By contrast, SUTs currently dominate the research and clinical supplies manufacturing market, which is only ∼10% of the upstream bioprocessing market (∼$525 million) and involves many times more systems but less expensive ones at smaller scales. The current market for SUT equipment in commercial good manufacturing practice (GMP) manufacture is ∼$150 million, mostly representing storage containers, manifolds, tubing, and other disposables used in hybrid systems with stainless steel bioreactor-anchored systems.

The SUT market is currently dominated by a few major vendors. Thermo Fisher is the market leader with ≥50% share, followed by Sartorius Stedim, EMD Millipore, GE Healthcare, and Pall Corporation. A mid-tier group of vendors includes ATMI and Xcellerex. Those are followed by a large number of companies splitting the remaining (10–15%) of the market. So the current market can be seen as both highly concentrated (in terms of large-scale devices and large-scale buyers) and fragmented (in terms of the number and variety of smaller-scale suppliers, components, and technologies). We expect larger vendors to increasingly seek larger sales and market shares by offering bundled systems that provide the convenience of major equipment and documentation, often along with bioprocess consulting, validation studies, installation, training, and service contracts.

SUT State of the ArtStainless-steel bioreactor and other upstream bioprocess equipment designs have generally remained unchanged for years. In some ways, that is mirrored in SUT devices, with their

current predominant approach involving adaptation of classic stainless-steel equipment, such as adding bags/liners to stainless-steel bioreactors, mixers, and other vessels. Although many advanced designs have been introduced, most SUTs are first-generation/legacy products today. Numerous studies have reported good comparability among processes using disposable and stainless steel equipment for clinical and/or scale-up production. However, there is as yet little industry experience with fully disposable GMP manufacture of commercial products at world-class scale, such as is required for MAbs.

Some single-use bioreactors involve multilayered, laminated plastic bags and/or liners installed on site into essentially classic stainless steel bioreactors, then disposed of after use. Some single-use bioreactor systems (such as the Wave system) involve bags on rockers or other mixing platforms. Still others (such as the PBS Biotech system) use pneumatic lifting to provide consistent mixing. Dominant bioprocessing suppliers have invested in bag manufacturing facilities, so it is likely that the bulk of the SUT market will continue to use bags for at least the next five years. But flexible bags introduce complications in their securing and sealing, including bearings for stirrers and ports required for sampling, probes/sensors, feeding, and harvest.

Innovation is needed in that segment, and many vendors are aggressively investing to meet that need. According to our annual survey of biopharmaceutical manufacturers and their vendors, suppliers are actively researching new single-use technologies. For example, nearly 41% of this industry’s vendors have at least one R&D program associated with disposable bioreactors, bags, or consumables. As our study shows, that is driven by the large percentage of end users (biomanufacturers) demanding innovations in areas such as single-use purification (noted by 37.9%) and bioreactors (37.0%). So such new technologies are likely to be well received.

One problem inhibiting innovation is that successful single-use product lines tend to become locked in afterlaunch, with both vendors and end users resisting change. Many changes could disrupt the operations of present customers — many with regulatory filings or plans committing them to specified equipment — and some changes could require customers to repeat expensive validation testing. Many suppliers have invested heavily in current bag technologies. These trends are restricting innovation and slowing product changes in SUT.

With the overall bioprocessing market and its sectors projected to grow steadily at about 18–20%, the current upstream SUT market (supporting research and clinical supplies manufacture) will more than double to $1.3 billion in 2016 (Table 1). Even more dramatic growth in the upstream market is expected in 2016 and beyond as SUTs begin to be adopted and accepted for commercial (GMP) product manufacture. We estimated the 2016 market at $1.5 billion market, growing to >$15 billion in 2020 (when an estimated 50% of newer commercial manufacturing will be based on SUT). With initial world-class SUT installations — e.g., anchored by multiple large (≥1,000 L) bioreactors operating in parallel, easily costing well over $100 million (rather than ≥$200 million or much more for comparable-capacity fixed stainless steel) — our projection of a $1.5 billion upstream SUS market in 2016 presumes only seven to 10 such commercial-scale systems being purchased. Many of those are likely to involve MAb manufacture, including biosimilars.

So in as short as five to seven years, the market for commercial-scale single-use equipment should go from only ∼$150 million (based on plastic parts used with stainless-steel systems) to integrated, commercial-scale/GMP single-use systems exceeding those in the small-scale research and clinical-scale market. However, the commercial market is likely to be concentrated among a few major vendors, primarily those system integrators with their own bioreactor lines that sell large, bundled systems. The research/clinical-scale market should continue to support a greater number of suppliers, including new entrants.

Issues Holding Back SUTThe current R&D/clinical-scale SUT market concentrates primarily on performance and cost benefits. The commercial market is primarily concerned with safety, which must be the primary concern for biopharmaceutical manufacturers. Safety is thus critical for SUT as it graduates to commercial, GMP manufacturing.

Uncertainties regarding regulatory acceptance and perceptions regarding plastics safety present a major obstacle that SUTs must overcome for such equipment to be widely adopted in commercial GMP manufacturing. Many plastics currently used in construction of single-use equipment are decades-old legacy polymers that have been long used for medical devices (including implants) and pharmaceutical packaging. It is widely acknowledged, however, that many such materials were “grandfathered” or approved long ago using outdated testing and standards. So the quality criteria used to approve medical devices — even implants — and pharmaceutical packaging may be inappropriate for product-contact applications associated with biopharmaceutical manufacturing.

Current SUT plastics are not unsafe. However, they often lack modern studies and assessments that are suitable and specific for biopharmaceutical manufacturing applications, tests that may be required by regulators. Few of these polymers have available the full spectrum of chemistry and toxicology data (e.g., multiyear carcinogenicity and reproduction studies) needed to fully assess their safety for use in biopharmaceutical manufacturing — including their leachates (substances diffusing out) and by-products from gamma-ray sterilization. Even fewer have undergone modern safety assessments assuming long-term patient exposure. However, the US Food and Drug Administration (FDA) has been reasonable regarding SUTs for product manufacturing. It has not applied stricter standards for the same plastics that have long been applied to other regulated products (e.g., medical devices and food packaging). However, if toxicity-related problems or controversies arise in SUT-based biopharmaceutical manufacture, those plastics could later be held to higher standards.

Until a critical mass of documentation clearly demonstratesthat SUT plastics contacting process streams present less or comparable hazards than do stainless steel components, few commercial product manufacturers can be expected to adopt the former over the latter for commercial product manufacture. Ideally, that will require studies performed and published by polymer manufacturers. With that potentially bringing up safety issues regarding other uses of their plastics, it remains to be seen whether those companies will test and make the requisite disclosures. But the compelling economics of disposables for commercial manufacture dictate that some product manufacturers will establish precedents for marketed product manufacturing using SUT. Improved methods are also needed for assaying and predicting immunogenicity and other toxicity problems that could arise from culture media comp

onents, active agents, excipients, and formulated products interacting with plastics leachates.

Bioprocessing regulatory approvals involving SUT require validation testing, with process stream samples tested for diverse plastic leachables (substances that diffuse out under routine conditions) and extractables (substances that leach out under extreme experimental conditions) along with toxicity studies of the plastics involved, including implantation in laboratory animals (3). Full validation testing of samples from actual product runs generally costs ∼$100,000 for each major contact plastic tested (e.g., the inner contact layer of bioreactors, mixers, and other container bags). Chemical analysis often identifies many polymer (monomer, partially reacted, and other polymerization by-product) leachates for which few in-depth toxicology studies and safety assessments are available. Of particular interest are by-products from gamma irradiation sterilization of plastics.

Polymer leachates are not an abstract problem. The biopharmaceutical industry has already had a major related problem. Eprex recombinant erythropoietin/EPO from Ortho Biologics (Johnson & Johnson)caused more than 300 deaths among European anemia patients (4). When the product was reformulated, one or more substances (including cross-linking agents) leaching from rubber used in prefilled syringes were widely assumed to have altered the protein structure. That caused patients to develop antibodies to both the injected and their own endogenous EPO.

Most plastics are organic polymers, and many aspects of current SUT materials are considered proprietary, thus not always discussed by suppliers. Components such as the “tie layers” or adhesives used to construct multilayer laminated bags and liners (and even labels on the outside of bioreactor bags) have been shown to detectably leach into process streams.

Supply chain issues can be a challenge involving polymer manufacturers and downstream formulators and parts fabricators. Much processing, formulation, secret additives, and other aspects of plastics manufacture remain undocumented and undisclosed. Only a minority of suppliers yet have fully secured and documented their plastics and parts supply chains, although most are actively working on this.

Survey MethodologyThis eighth in the series of annual evaluations by BioPlan Associates, Inc. yields a composite view and trend analysis from 352 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) from 31 countries. The methodology also included an additional 186 direct suppliers (vendors) of materials, services, and equipment to this industry. The latest survey covered such issues as current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, employment, and training. The quantitative trend analysis provides details and comparisons by both biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the United States and Europe.

New plastics that offer adequate performance for SUT and are documented to be as comparably risk-free as stainless steel are likely to be widely used in the biopharmaceutical industry. If documented or perceived as safer than current legacy plastics, they will be used. That provides a strong incentive for improved SUT polymers/plastics development. Kynar brand polyvinylidene fluoride (PVDF) from Arkema and other fluorinated polymers, such as Teflon brand polytetrafluoroethylene (PTFE) from DuPont, are among the most stable (inert), least-leaching, and nontoxic polymers. The former is a leading candidate for SUT applications, including the inner contact layer of bioreactor bags. It could provide a single contact plastic for all upstream single-use bioprocessing. High cost, however, is restricting PVDF adoption.

Currently no explicit chemical or safety-related regulations apply to SUT plastics. The Bioprocessing Systems Alliance (BPSA) and other voluntary standards organizations issue guidelines, but those have no force of law and generally involve testing methods rather than specifying minimum performance requirements.

Toward a GMP FutureDisposable bioprocessing systems primarily made of plastics are on track to usurp the current domination of fixed, stainless-steel bioprocessing systems. They are already dominating R&D and clinical supplies manufacturing. In coming years, single-use systems will be used for commercial manufacture, and that market will rapidly overtake the R&D/clinical supplies market. However, for single-use systems to fully move into commercial/GMP manufacturing applications, concerns regarding toxicology, safety assessments, and related perceptions of plastics will have to be addressed.

Author Details

Ronald A. Rader is senior director of technical research at BioPlan Associates. He has 25+ years experience as a biotechnology and pharmaceutical expert, and publisher. He is also president of Biotechnology Information Institute. Corresponding author Eric S. Langer is president and managing partner at BioPlan Associates, Inc., Rockville, MD; 1-301-921-5979;